Monthly Report July 2021 Entry #7

Please read P2PIncome's most recent investment-portfolio report for 2025.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

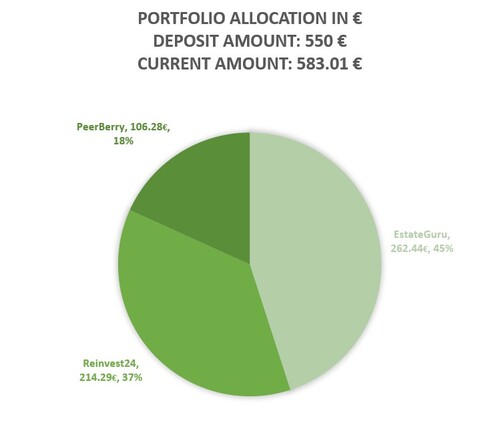

The current portfolio breakdown:

July has brought about mixed feelings, while PeerBerry and Reinvest24 have both performed as expected, EstateGuru continues to disappoint us. We have two loans that are currently in late repayment and in talks with EstateGuru to discuss fund recoveries. Judging by the performance of these loan contracts we are skeptical as to whether or not we will actually see the missing funds returned.

ReInvest24

Reinvest24 is an Estonian peer-to-peer lending platform that deals gives retail investors temporary real estate equity in exchange for borrowing capital. Reinvest24 acts as the mediator between borrowers and investors and delicately manages a high yielding, secure peer-to-peer lending experience.

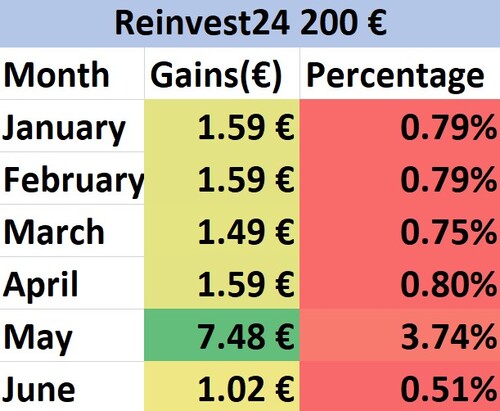

Starting Amount: € 200

After 9 Months: € 214.29

Total Percentage Increase: 7.14%

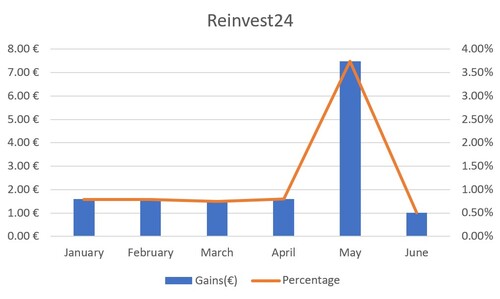

As you can see from the graph the returns from Reinvest24 are very consistent per month. This is because the borrowers are following the agreed upon schedule for their loan request. The spike that you see during the month of my May was due to one of our loan contracts' equity increasing in value. The value of the one property rose by 5 percent, meaning it gave a 2.5 percent increase on our monthly performance for Reinvest24. Had it not been for this massive spike, Reinvest24, would have been our bottom performer.

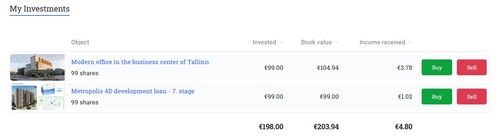

For reference, in the image below please see loan contract, "Modern office in the business center of Talinn". That being said, until the loan contract is fully realized we will not know with certainty whether or not the value of the equity will remain. It may just as well decrease below the amount we purchased the equity for various and even unpredictable reasons. Ultimately, we are very pleased with our experience on Reinvest24, and as the new real estate crowdfunding platform we see a lot of hope for Reinvest24.

Marketplace Review

In our previous month we included that we had started investing in a new loan, a development in loan in the seventh stage. The loan has already begun to pay monthly interest which is another great sign, not only for Reinvest24, but also for us.

Too conclude, for this month we continue to be satisfied with Reinvest24 and the investment decision to stay with them.

PeerBerry

PeerBerry is a peer-to-peer lending service that aggregates loan originators to service loans on PeerBerry's marketplace. Ever since, PeerBerry has been known as the fastest growing P2P lending marketplace. Their success is mostly attributable to its various strengths and benefits, such as, their dual buyback guarantee, zero percent default rate, state of the art platform and support system.

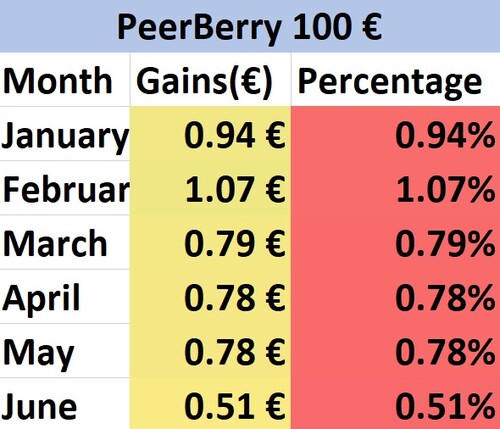

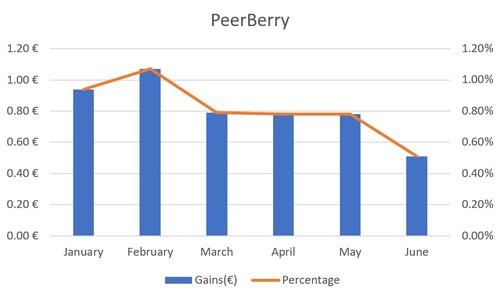

Starting Amount: € 100

After 9 Months: € 105.99

Total Percentage Increase: 5.99%

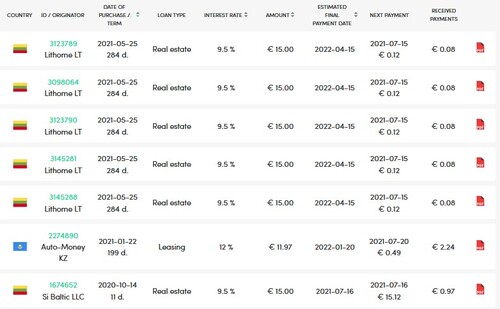

Our investment experience has been very enjoyable so far. The payouts are regular and consistent, some times higher, sometimes lower, but always within the same range. We have found that many of our loans get paid back very quickly and are subsequently reinvested. This is a great detail because our investment value is constantly being compounded. Furthermore, this has all been achievable by simply setting up our auto-investing tool.

At the moment we see that our loan contracts are finished, we can expect that by the next day all the capital will be reinvested unless we dictate otherwise, which has been simply pleasurable, to say the least. There is a 10 EUR minimum investment entry to use PeerBerry and yearly return ranges from 9 to 12 percent.

Marketplace Review

We have a very hands off approach in PeerBerry's marketplace. All pay outs have been accurate to PeerBerry's prediction. Most of our loan contracts are scheduled to end by April next year, looking at the way things have been, we are confident that PeerBerry will continue to perform in a healthy fashion.

We did notice that payments have decreased this month. This is due to the fact that the majority of loans in our portfolio were invested in, recently. The loans will start paying out larger amounts towards the middle and end of their loan contracts.

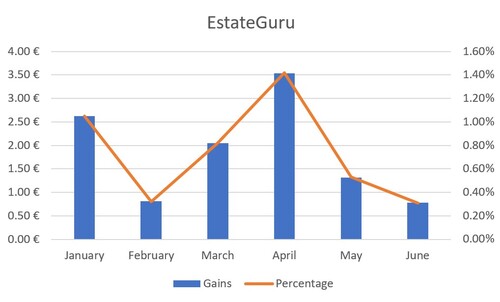

EstateGuru

EstateGuru was founded in Estonia in 2013 with a vision to break down the barriers of real estate investing. Since the platform's creation it has ascended to the top position for real estate crowdfunding in terms of capital, projects and investors. EstateGuru has a strong dedication to asset and risk management. All of their loans are backed by 1st or 2nd rank mortgages, and EstateGuru has had a one hundred percent success rate in all fund recoveries. To invest with EstateGuru there is a minimum investment entry of 50 EUR and yearly returns are projected to be 8 - 12 percent.

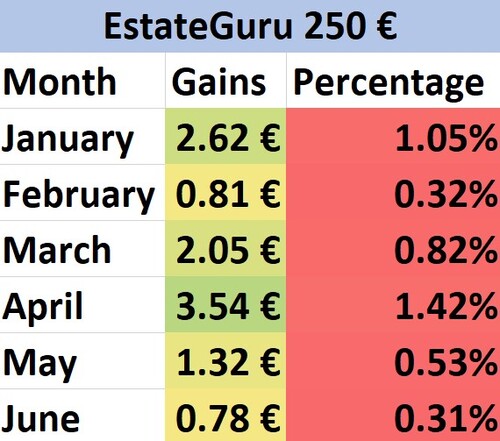

Starting Amount: € 250

After 9 Months: € 262.44

Total Percentage Increase: 5.85%

Unfortunately, EstateGuru has had a very poor performance with us. Even though we took measures to ensure that our investments were not high risk, it appears that some of the projects were not up to standard. Upon this realization, the moment we saw that two of our loans are considerably late, we have decided that we would be pulling out of EstateGuru and moving our funds to a new platform. The next platform will most likely be Swaper, Mintos, RoboCash or Debitum Network.

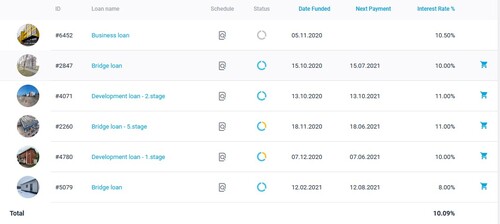

Marketplace Review

As you can see below, EstateGuru has deemed our overall IRR to be 10.09% based off an average of their predicted return. In actuality, what we see is a far bleaker yield. We are really surprised to see EstateGuru continue to perform in this manner, and we are awaiting to see what will be of the two loans that are currently late. Considering one of them is 28 days late and the other is 19 days late, and barely a word of communication from EstateGuru, our hopes are not high. Not to mention, this entire experience with them has been upsetting. For a platform of such high caliber and experience, we expected better.

Perhaps in the months to come, EstateGuru, will be able to reclaim the principal missing. We are not positive that we will see any of the interest we should have received for the last few months. In any rate, migrating this portion of our portfolio to a platform that issues short term consumer loans may prove to be more profitable for us in the long run. We have currently disabled our auto-investing tool and are awaiting our loans to be finished so that they may be cashed out.

Comparing Platforms

It has definitely been a three way tug of war between these platforms. Every month comes with a different update, a different bottom performer and top performer. Interestingly, this comes from EstateGuru's strange behavior and Reinvest24's successful execution of property management. A property increasing by five percent, which happened in our previous monthly blog was a rather impressive event. PeerBerry has been very predictable, which makes us feel confident in receiving the 9% IRR that our portfolio has predicted for us. We are looking forward to Reinvest24's continued success and will make moves to migrate our EstateGuru funds to a more appropriate platform.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 14.29 | 7.1% |

| PeerBerry | € 100 | € 5.99 | 5.65% |

| EstateGuru | € 250 | € 12.4 | 4.86% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

Due to COVID-19 restrictions still putting a huge strain on small businesses affecting overall liquidity, seeing two late loans on EstateGuru is not the end of the world. EstateGuru is currently in talks with borrowers to find a way to retrieve the late funds. Which makes us consider using the secondary market to potentially sell off the problems that we are dealing with on EstateGuru. PeerBerry has been a very safe investment as far as we are concerned. And Reinvest24 appears to be more humble until it makes a successful execution increasing in value of equity.