Monthly Report May 2021 Entry #5

Please read P2PIncome's most recent investment-portfolio report for 2026.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are PeerBerry, Reinvest24 and EstateGuru.

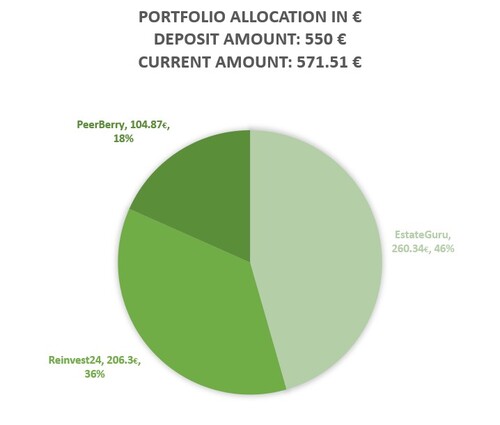

The current portfolio breakdown:

April has been a positive reinforcement on our investment decisions across all three platforms. Reinvest24 and PeerBerry have performed consistently for the last 5 months. EstateGuru has almost out performed both Reinvest24 and PeerBerry due to a spike in payments this month. In the beginning, we were worried, due to the delayed payments coming from EstateGuru which we will go in detail below. However, it appears as if EstateGuru has begun to function properly.

In our previous monthly report we noted that EstateGuru lost a percentage to PeerBerry in terms of total portfolio allocation, In the latest month of April, EstateGuru, has taken back that percentage.

EstateGuru

Estateguru is the largest real estate crowdfunding platform in Europe. The platform was founded in 2013, in Estonia. Investing in Estateguru requires a 50 EUR investment and the yield is expected to be a yearly 8 - 12 percent.

EstateGuru operates all over Europe and has been an enjoyable experience for both investors and borrowers. A few interesting facts about EstateGurus operations, reported by EstateGuru: roughly 9 out of 10 investors on EstateGuru continue to invest with them and roughly 50% of borrowers continue requesting loans from EstateGuru. The real estate crowd-funder is also licensed in multiple countries in Europe such as the U.K and Lithuania.

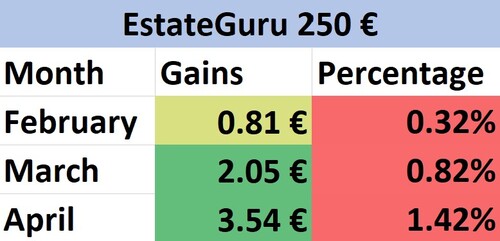

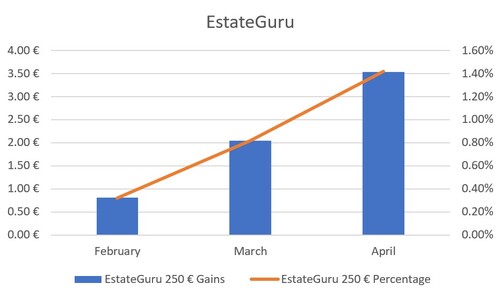

Starting Amount: € 250

After 7 Months: € 260.34

Total Percentage Increase: 4.13%

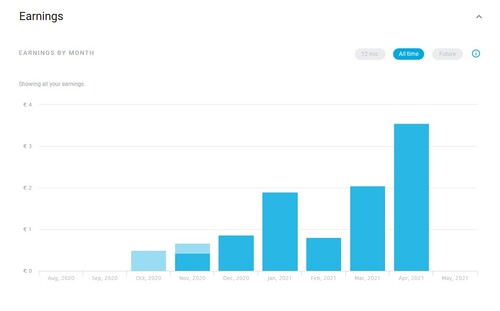

As it can be seen in the data tables above that, EstateGuru, has started to increase its monthly payments as well as begin making them on time. In the first few months we were concerned that EstateGuru was experiencing problems. As of now, if the trajectory continues, we are confident that EstateGuru will provide us the yields that we initially expected.

Marketplace Review

EstateGuru continues to repay back a substantial amount of principal. At this point, since we are seeing consistency, it's assuring to receive both interest and principal. As things continue, we should be able to select a new listing on EstateGuru within two months. In regards to the actual late payments, we are still receiving limited information from their website and communications team.

Considering the current trend we have in our portfolio, we anticipate EstateGuru's next monthly payout to be even more impressive than this month's.

PeerBerry

PeerBerry is one of the fastest growing peer-to-peer lending platforms in Europe. PeerBerry is accessible to investors all over the world. The minimum investment entry is 10 EUR and the expected yearly return ranges from 9 - 12 percent.

Peerberry was founded by loan originator, Aventus group, the company wished to build a platform that would offer loans from multiple loan originators. Aventus Group originally issued loans on Mintos' platform, after realizing the potential in P2P lending they decided to build their own. And thus, PeerBerry was born.

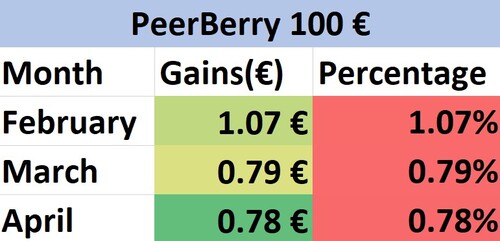

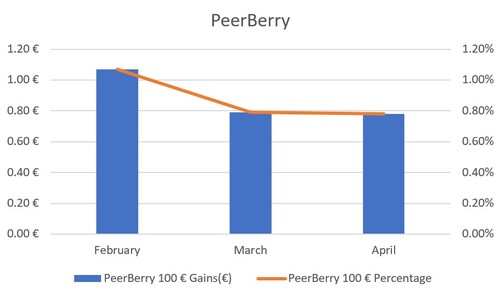

Starting Amount: € 100

After 7 Months: € 104.87

Total Percentage Increase: 4.87%

PeerBerry continues to perform very well. From the start of our investment we could always expect 0.80% to 1% payout of interest a month. PeerBerry offers a wide array of different investing options such as mortgage lending, business lending and consumer lending. PeerBerry is an exceptionally interesting peer-to-peer lending platform because of the amount of security that comes along with using PeerBerry. All loans on PeerBerry are backed by some form of collateral and all capital is reinforced by two different buyback guarantees.

The second buyback guarantee only operates if the first one is unsuccessful. PeerBerry explains this as a buyback guarantee and a group guarantee. A buyback guarantee implies that if a borrower defaults than the the loan originator will purchase the loan back. If the loan originator is unable to purchase the loan back because it is the loan originator that is defaulting, then all the loans on the platform will pool in together to assist that one failing loan originator.

Marketplace Review

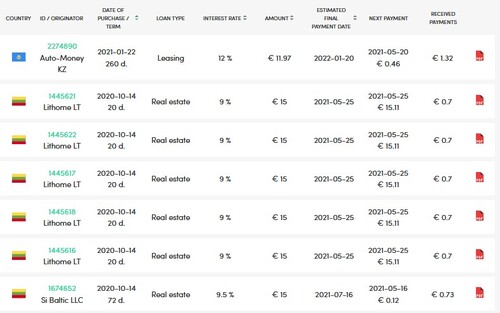

As it currently stands, all of our loans on PeerBerry are due for the 25th of May. It will be interesting to see if they all pay out on time. If they do, it will reflect in our portfolio as a decent amount of interest. It will also be nice to see if PeerBerry's auto-investing feature will quickly move the money back into the market. So far we can only say good things about PeerBerry's performance.

The loan amounts that we have with PeerBerry are substantially lower than that of EstateGuru or Reinvest24. Perhaps, the funds being smaller can provide some clarity as to why the loans and payouts have performed better.

ReInvest24

Reinvest24 is a unique real estate crowdfunding platform. Founded in 2019, Estonia, Reinvest24 offers a personal, tailored investing experience which yields a high 14.6% at a minimum of 100 EUR per investment transaction. It might be easier to understand Reinvest24 as a peer-to-business platform rather than peer-to-peer lending platform. This is because, all of the borrowers are first business entities that have partnered up with Reinvest24. The investors only have the option to lend capital to these borrowers.

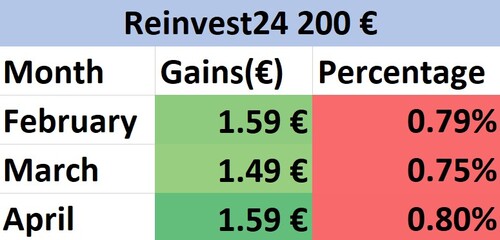

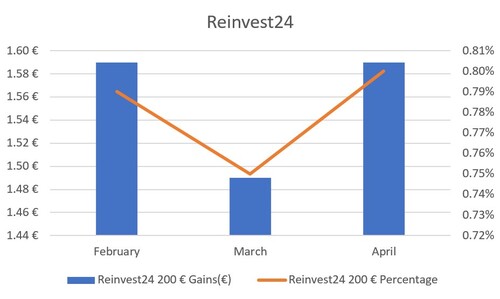

Starting Amount: € 200

After 7 Months: € 206.28

Total Percentage Increase: 3.14%

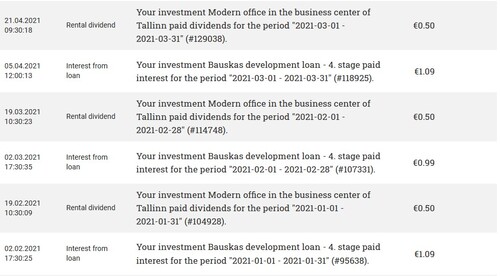

Reinvest24s performance does not vary by the month. As we have seen we receive roughly 0.70 to 0.80 percent on a monthly basis. We have noticed that our development project has paid out a substantial degree more than we projected. We have not been informed as to why this is happening. As it can be seen in the image below, for every euro we receive from our development project, we receive half from our project. Perhaps the payment structure will change, or full interest will be paid upon the reception of principal.

Even though the nature of the two investments are different, there is no reason for the rental dividends and the interest loan to be so vastly different. Ultimately, the amount of interest predicted for the projects were similar and yet the performance does not reflect what they predicted.

Comparing Platforms

The sudden jump in EstateGuru's performance was a reassuring indicator for us. We were concerned we made a mistake in choosing the platforms with the "supposed" best track records. This increase in pay outs has set EstateGuru well above Reinvest24. Reinvest24, although operating well enough, is now our bottom performer.

| Platform | Deposit | Payout | Yield |

| EstateGuru | € 250 | € 10.34 | 4.13% |

| PeerBerry | € 100 | € 4.87 | 4.87% |

| Reinvest24 | € 200 | €6.28 | 3.14% |

While there is still time to go we are satisfied at this stage of our investments. Considering the times our world is living in, it's impressive that none of our loans have defaulted. Though, there have been some late payments, but it has not been anything substantial.

Ultimately, we are concerned that high returns may mean nothing if the borrower decides not to default on his loan. This is what we keep in mind when we make our investment decisions. As of this month, there is not really too much to compare between the platforms. They all performed in the way that they should have. Perhaps Reinvest24 has some room to move, but as it is now is also satisfactory.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Verdict

EstateGuru is bound to have defaulters and late payments. It is at these moments that define the ability of a P2P lending platform. The positive correction displayed over the last three months is a great indication that EstateGuru was a great option for our portfolio. PeerBerry and Reinvest24 both operated the same way in April, as they did in both March and February. The amounts were reasonable. PeerBerry lived and is still living up to it's projected yearly return. Reinvest24, however, is still falling behind in pay outs.