Monthly Report Apr 2021 Entry #4

Please read P2PIncome's most recent investment-portfolio report for 2025.

Welcome to our monthly report on P2P platforms where we find the most exciting and worthy of a trial. Our current set of peer-to-peer lending platforms are PeerBerry, Reinvest24 and EstateGuru.

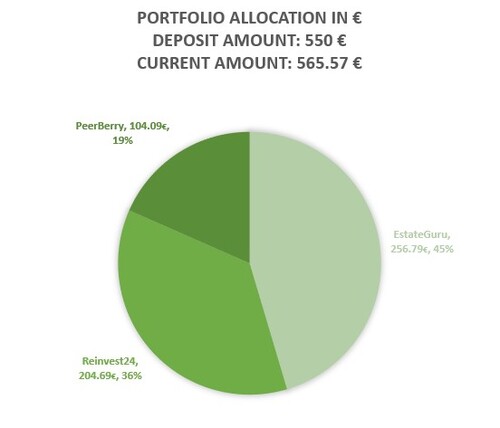

The current portfolio breakdown:

March is the indicator of a new chapter in our peer-to-peer lending experience with Reinvest24, EstateGuru and PeerBerry. It is also the first month where all platforms performed well, making the decision to choose the top performer a difficult one. Interestingly enough, as of this month, out of our entire portfolio, PeerBerry went from holding 15 percent to 16 percent.

Reinvest24's share did not change, but EstateGuru, lost their percentage to PeerBerry. While it's a great indicator for PeerBerry, it is an unfortunate loss for EstateGuru.

ReInvest24

Reinvest24 is a peer-to-peer lending real estate equity investment platform. While their business model may be confusing, at the heart of it is the revolution of the oldest asset class: property. The lender-borrower ecosystem on Reinvest24 functions by trading temporary equity positions of properties in exchange for loans. This model is more specifically for apartment rentals rather than any other form of property. Though other forms of property such as offices, hotels and larger scale projects are appropriate, and have and do fit, into Reinvest24's marketplace. Reinvest24 has a 100 EUR minimum investment deposit and project a yearly return of 14 percent.

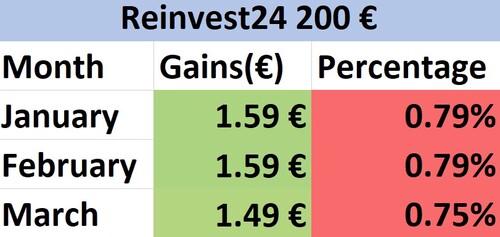

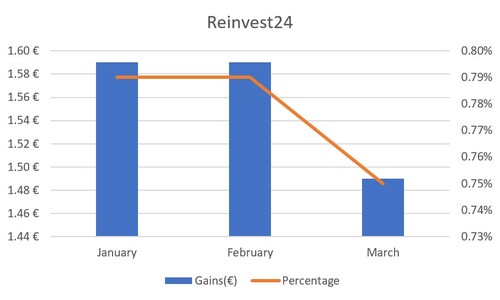

Starting Amount : 200

After 6 Months : 204.69

Total Percentage Increase: 2.34

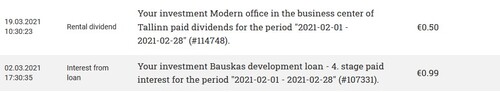

Since the completion of our loan contracts on Reinvest24 we have had regular payments in a 1.40 - 1.60 EUR range. The consistency of the returns helps us predict over a long period whether or not the risk of the investment is worth the principal. It's also reliable, as there is much value is knowing your borrower is consistently paying interest over time. Some borrowers are unable to pay consistently each time, creating an uncertain atmosphere and marketplace. To see that borrowers are paying back on time is one of the main reasons we chose Reinest24 as this month's top platform.

In our previous monthly update, we stated that Reinvest24's return is probably going to be more of a 7 - 8 percent rather than their average of 14.6. After all, this is a projected return and considering the severity of our current economic crisis it makes sense that the return would be less.

Marketplace Review

We are pleased by the consistency of payment as well as the fact that the payments are arriving on time. It is a lot more comfortable for us as investors to see that everything is working rather leaving us with the question, "where is my money?". In this regard, Reinvest24 is operating smoothly.

In the beginning we were experiencing a fair bit of cash drag. The projects we chose on Reinvest24 were not chosen due to their strengths, though they had them. We chose the platform Reinvest24 due to it's record and our analysis on their business model, which you can read up more about here in our Reinvest24 review. The projects themselves were selected because they were the only ones we could select.

One of the biggest problems with Reinvest24 is their lack of options in their market place. While all the projects are supposed great and profitable, their aren't many of them. This is because Reinvest24's team hand picks the properties they catalog on their site. Only after choosing and vetting them, are they offered to their investors. Reinvest24 is more of a peer-to-business lending platform. After these projects get funding, everything becomes smooth sailing.

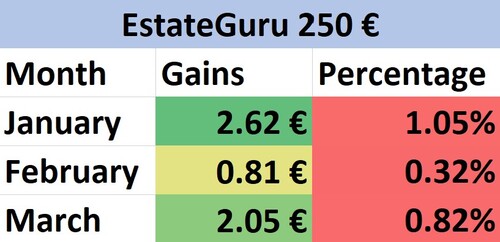

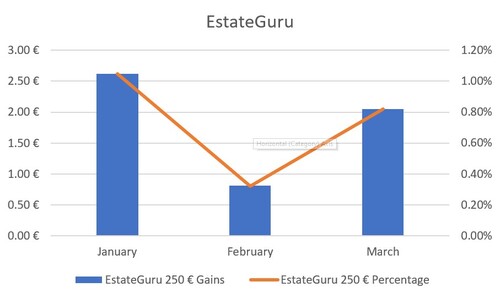

EstateGuru

In 2013, EstateGuru was founded in Estonia. To invest with EstateGuru there is a minimum investment entry of 50 EUR and yearly returns are projected to be 8 - 12 percent.

EstateGuru is a real estate crowdfunding investment platform. It is by far the largest in all of Europe and takes the top position in terms of market cap, investors, average portfolio size and location reach. EstateGuru services more real estate loan contracts than any other real estate lending platform in Europe.

Starting Amount : 250

After 6 Months : 256.79

Total Percentage Increase: 2.7

As of this month, EstateGuru overtakes Reinvest24 due to it finally paying out interest that should have been received in the previous month. The inconsistency of investing with EstateGuru leaves much to be desired. Especially considering these loans were chosen with the assistance of our auto-investing tool that was designed to only allocate funds to only low-risk loan contracts.

Marketplace Review

EstateGuru has paid us back a fair amount of principal through the loan contracts. This is in some sense troublesome because in order to invest with EstateGuru there is a requirement of 50 EUR. Which means if we're paid back 2 EUR every time a borrower decides he wants to give us back some principal, then we have to wait 25 times until we can reinvest it. Which is just additional cash drag as far as we can tell.

Our experience with EstateGuru so far has been unpredictable and in some ways, unsatisfactory. There has been little communication on the side of the company. The loan contracts do not perform the way Reinvest24 or PeerBerry does. Though I understand they are different platforms, all of our loans are in property. Yet, only EstateGuru, the most well-funded entity produces issues on a monthly basis.

While we are grateful EstateGuru was able to pay the amount interest it was supposed to this month, it's a far cry away from what it should have been.

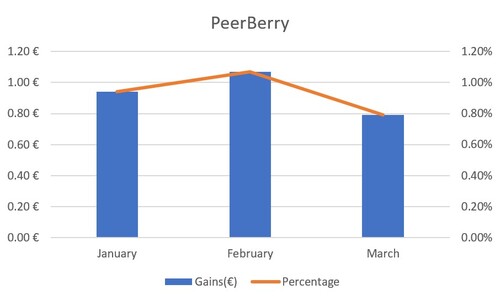

PeerBerry

In Latvia, 2018, PeerBerry was founded by a leading industry loan originator, Aventus Group. Aventus Group sought to create a peer-to-peer lending platform that would help their investors make money easily, and allow borrowers to receive loans without hassle.

Prior to their founding, Aventus Group offered loans on Mintos, after seeing what their platform could accomplish, they embarked on their own creation, PeerBerry.

There is 10 EUR minimum investment entry to use PeerBerry and yearly return ranges from 9 to 12 percent.

Starting Amount : 100

After 6 Months : 104.09

Total Percentage Increase: 4.09

Overall, PeerBerry continues to out perform all of our other investment contracts. The payouts have been steady and accurate to their advertised return rate. Currently, none of our payments are late or delayed and we can confidently say that we are satisfied with PeerBerry's performance up-to-date.

In our previous monthly report, we discussed the relevance of PeerBerry's very effective auto-investing tool and consumer based investment strategy.

Marketplace Review

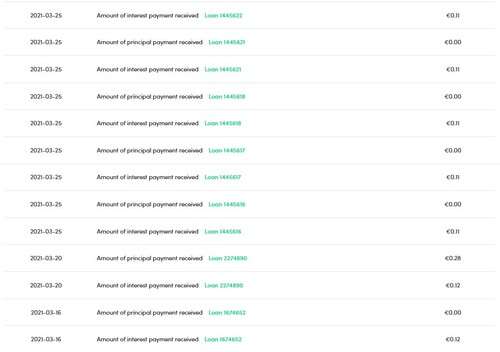

The way PeerBerry's marketplace operates is in small payments because many of the loan requests are not for high amounts. Some loans that come in are for only 10 or 11 euros. This is partially due to the economic conditions of some of the countries where borrowers are located. Many of these countries have low minimum wages that average 100 - 300 EUR a month. So while for someone in the Netherlands who does not think much of 10 euros, for someone in Ukraine, it might be enough to get something going.

Due to the nature of the small loan sizes, the payouts are also often smaller. To explain the picture above, the transactions with no income received don't mean anything. The principal of the loan agreements is generally paid back at the end of the loan contract.

Comparing Platforms

As opposed to previous months, PeerBerry did not perform that well for the month of March. Though they still out performed Reinvest24. Reinvest24 has had the poorest performance but the consistency of their loan payment is something we value enough to move them to the front position this month.

| Platform | Deposit | Payout | Yield |

| EstateGuru | 250€ | 6.79€ | 2.70% |

| Reinvest24 | 200€ | 4.69€ | 2.35% |

| PeerBerry | 100€ | 4.09€ | 4.09% |

Reinvest24 has truly begun to prove itself with consistent returns every month. At this rate we're feeling more comfortable in trusting them as a platform. Towards the end of our loan contract, these small sums have to grow by at least half or even a full percent in order for us to be satisfied with the experience as a whole.

EstateGuru, still flaunts an unpredictable nature, as payments vary in lateness and amount. This month they were able to almost provide a full percent paid in interest but it has yet to make up for the disappointing experience in regard to cash drag, late payments and small payments.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Verdict

You may notice the deposit amounts are rather humble, as we went with small amounts because we wanted to accomplish something specific. It is of the utmost importance for us that these sites advertise their purpose properly. If you're here it's because you're interested in micro-finance. It means you're interested in using small amounts to lend to many people, with many other lenders. The entire concept behind peer-to-peer lending is really to allow the average person an opportunity to make an income. These are the reasons we're really happy with PeerBerry and upset with EstateGuru.

The payouts on EstateGuru just leave us with sitting capital. The payouts and auto-investing tools of PeerBerry have ensured that we're always reinvesting capital. We have high hopes for Reinvest24, and judging by their performance, we think they will be a serious contender to PeerBerry.