P2PIncome Reports on the Status of Our Investments | Jan 2022

Please read P2PIncome's most recent investment-portfolio report for 2026.

The new year promises to be exciting, if only because the entire world is beginning to recover from the SARS-CoV-2 (COVID-19) Pandemic, and all eyes are on financial-recovery trends. P2PIncome's financial experts continue to track their peer-to-peer lending investments on 3 platforms: Reinvest24, PeerBerry and EstateGuru. There are also plans in place to add more sites, with the goal of expanding our understanding of market trends and behaviors. In this report, we cover the market's performance during the month of January 2022, including our satisfaction with Reinvest24 and our ongoing concerns about EstateGuru.

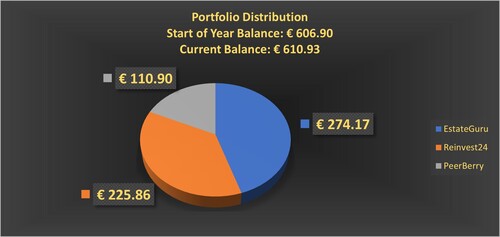

Overview of Our Current Portfolio

We had initially deposited 250 euro into EstateGuru, 200 euro into Reinvest24, and 100 euro into PeerBerry just over a year ago. The final balances in December 2021 had reached 272.56, 224.24, and 110.10 respectively. We enjoyed an overall Return on Investment (ROI) of approximately 10.5%, which was more than satisfactory considered how problematic of a year it was. Entering the new year we will start with 2021's final numbers and report all gains and losses from those points.

Reinvest24

Since 2018, Reinvest24 has been a key platform for peer-to-peer investments in the real-estate market. Developers seeking to fund real-estate projects, particularly renovations, can submit their projects for investment. After conducting a rigorous screening process, Reinvest24 posts the project to its marketplace, where investors purchase portions of the project. This entitles the investor to rental dividends, in addition to standard gains, which often exceed 12.5% APY.

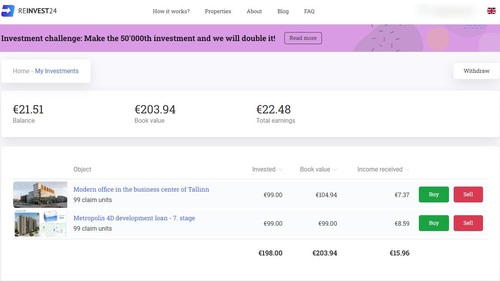

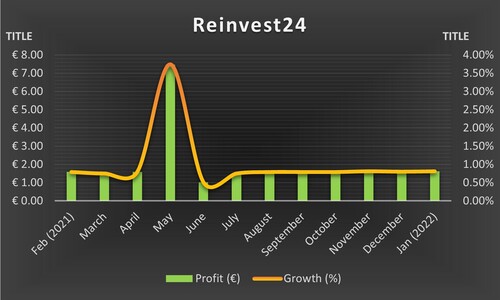

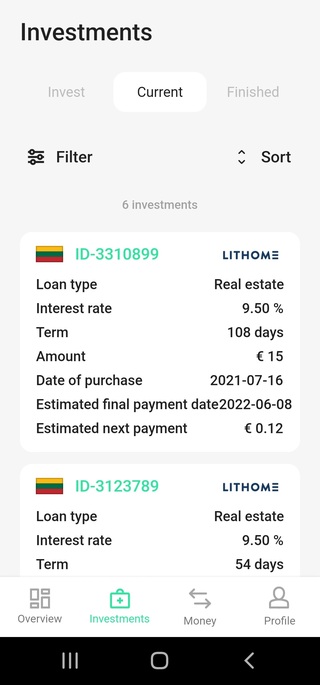

Reinvest24 - Our Investments - Jan 2022

Initial Balance: € 224.24

January 2022 Gains/Losses: € 1.62

Total Increase: 0.72%

Keeping with its general trend, our Reinvest24 portfolio gained 0.72% during the month of January 2022. We observed similar growth every month of 2021 other than May. We anticipate similar performances the rest of the year, and when we add rental dividends and realized equity, we have every reason to be highly optimistic about Reinvest24. Thus far, the site has not disappointed, and we don't foresee any downturn, given their sound approach to screening.

Our Reinvest24 portfolio currently consists of two projects: a small office complex in the Estonian capital of Tallinn, and a development deal in Chișinău, Moldova, currently at Stage-7. We've enjoyed consistent earnings from the site, and the opening month of 2022 is no different. Our invest grew by another 0.72%, and this month we will select new investments for our current balance of approximately 20 euro. In the meantime, the total book value remained the same, at 203.94 euro.

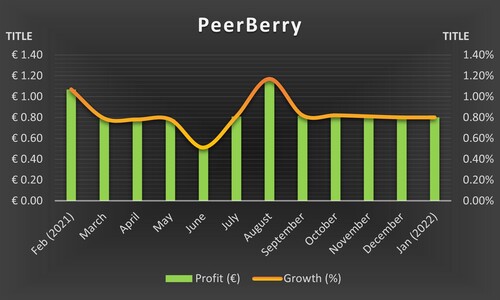

PeerBerry

P2PIncome's financial experts continue to recommend PeerBerry as a great platform for investors new to P2P. The site is easy to use, and the marketplace is packed with attractive investment opportunities. Because the platform has a solid buy-back guarantee, investors need to fear losses, and the investments tend to yield attractive rates. Over the course of 2021, we enjoyed over 10% gains, and the first month of 2022 continued that trend, yielding 0.73% for January.

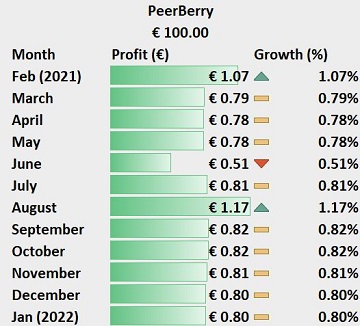

PeerBerry - Our Investments - Jan 2022

Initial Balance: € 110.10

January 2022 Gains/Losses: € 0.80

Total Increase: 0.73%

We've grown accustomed to gains of approximately 0.75% per month from PeerBerry, and the platform opens 2022 on par with last year's performance. We gained 0.80 euro, which amount to a gain of 0.73% for the month. We currently carry a balance of around 20 euro, which we will invest in new notes in due course. We have nothing but positive things to say about PeerBerry, and particularly about its app, which we've selected as the best p2p mobile app among European platforms.

Whether you're interested in a real-estate loan or a short-term note, PeerBerry has myriad options. The site is quite simply to navigate, and once you've set up your auto-invest tool you can pretty much sit back and just let it earn money for you. How you diversify your funds in entirely up to you, but the platform provides helpful blogs and suggestions on how to reach you financial goals, and how to set up your auto-invest to realize them.

We are still waiting for several of our investments to come to term, at which point we will strategize and reinvest. In the meantime, we are quite pleased with PeerBerry, and highly recommend the platform.

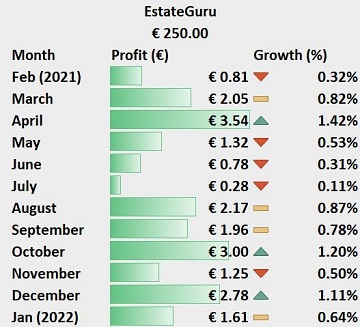

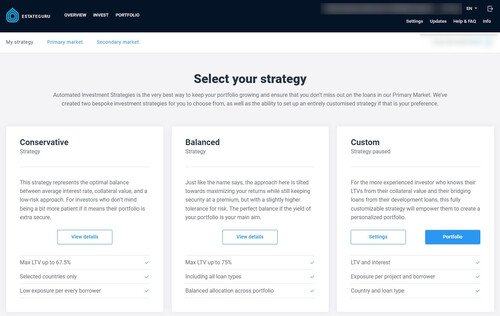

EstateGuru

Near the end of 2021, we began to express our concerns regarding EstateGuru and the platform's seeming inability to address ongoing problems with some of its borrowers. We watched as terms were repeatedly renewed, in order to avoid defaults. EstateGuru allowed interest-only payments from borrowers, and understood the logic to that approach, the bumps and bruises started to add up. We considered liquidating our notes on the secondary market and pulling our funds from the site, but decided our readers would benefit from a first-hand account of the issues the platform faced.

EstateGuru - Our Investments - Jan 2022

Initial Balance: € 272.56

January 2022 Gains/Losses: € 1.61

Total Increase: 0.59%

As January came and went, the ongoing saga of Bridge Loan #2260 continued to mar our taste for EstateGuru. We had hoped the matter would be solved, but alas we wait still. The site's willingness to allow the borrower to make interest-only payments in an attempt to avoid default is sub-optimal, and we are curious to know how soon this issue will be permanently resolved. Regardless, we earned a paltry 0.59% for the month, bringing our total on the site to just under 275 euro.

It's important to keep in mind that EstateGuru has a lot going for it. The platform crossed the 500-million-euro funding mark mid-January, in addition to increasing it's loans by nearly 70% and its revenues by nearly 60% over the course of 2021. The platform has great potential, and we really do hope they manage to negotiate a satisfactory settlement to the loans that have troubled them. It should also be noted that we haven't actually lost money investing in EstateGuru, and our complaints have more to do with opportunity cost and inconvenience rather than losses.

Comparing Platforms

Reinvest24 continues to be a beacon of investment brilliance. The site's strategy of providing equity-based peer-to-peer investment opportunities is excellent. Users enjoy a combination of interest gains and rental dividends, and the steady gains on the site, usually around 0.75% per month, makes it a very reliable site. We highly recommend it for investments of any size.

PeerBerry is also an excellent site, and we're particularly pleased by its mobile app. Like Reinvest24, the gains on the site are rather stable, making it an easy portfolio to assess. Their buy-back guarantee means investors need not fear losses, and the easy-to-use platform is ideal for those dipping their toes into the investment pool.

We want to like EstateGuru because the idea behind the site is solid. But as of right now we face serious challenges due to the unclear approach to potential defaults. We don't know whether they're simply trying to keep their default numbers safe, or whether they have a long-term strategy they genuinely believe will work. Regardless, until the matter is settles, they will remain near the bottom of our recommendation lists.

| Platform | Balance | Payout | Yield - 2022 |

| Reinvest24 | € 224.24 | € 1.62 | 0.72% |

| PeerBerry | € 110.10 | € 0.80 | 0.72% |

| EstateGuru | € 272.56 | € 1.61 | 0.59% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

2022 should be a great year for peer-to-peer investments. The lending market survived the pandemic, and several top platforms made real gains despite the tough times. Reinvest24 remains our top recommendation, because the site's additional source of income (rental dividends) and equity-based investment format mean more money in your pocket while enjoying added layers of security. PeerBerry is also an excellent site, especially if you're brand new to the market, but our overall top pick is Reinvest24.