The Russo-Ukrainian War and Global P2P Lending Markets

Global Crises and the P2P Market

The global economy is still reeling from the effects of the COVID-19 Pandemic, yet it now faces a threat with the potential to eclipse Covid: the Russo-Ukrainian War. Russian troop build-up along the Ukrainian border, as well as ongoing threats from President Vladimir Putin, had invited months of speculation from politicians and pundits alike. Some were certain an invasion and consequent war were imminent, while others argued Putin's threats were a tactical ploy to expand his influence in the region. All doubts were put to rest on the 24th of February 2022, however, when Russian troops crossed into Ukraine from several fronts, supported by missile strikes and air support.

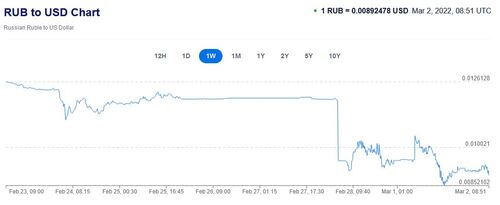

Fear of a protracted land-war and the mass casualties likely to ensue left world leaders with no choice but to respond. Condemnations, threats of sanctions, and statements of solidarity with the people of Ukraine rang out from capitols around the world. The marketplace responded in a more quantifiable manner: Global oil prices rocketed to over $100 a barrel, natural gas valuations increasing by over 60%, and Russia's national currency, the rubel, plummeted. As the US, UK, and EU introduced their first wave of sanctions, the rubel lost over a third of its value, and in response the Russian Central Bank raised the key interest rate to 20 percent, up from 9.5 just a few days prior.

Soon after, President Putin introduced the terrifying specter of nuclear engagement by placing his nuclear-deterrent forces on "high alert," in response to which the rubel fell even further. The West threatened a second wave of sanctions, and companies started to pull their activity from the region, some due to concerns over the security of their assets, others as a kind of boycott against Russia. These events have led P2PIncome's experts to address the question of how a global crisis effects the world economy in general, with a special focus on the likely consequences for the peer-to-peer lending market.

Currencies in Times of Crisis

As a general rule, markets seek stability and equilibrium. While reality is dynamic and no market is ever entirely stable, the goal of good public policies and economic strategies is to "zoom out," view the big picture, and see what can be done to effectuate stability over the long term. The one thing the global economy cannot tolerate is massive political upheaval and the instability it ushers in. When a country considered to be an economic "mover" enters into a war, the market tends to respond very negatively. Currencies lose value, resulting in inflated debt. As borrowers watch the value of their money plummet, the likelihood they will repay a loan dwindles toward zero.

The Effects on the P2P Borrower

The moment a currency losses value, it becomes more difficult for borrowers to pay back loans, especially loans taken in foreign currencies where the conversion rate becomes more unfavorable with every passing day. For example, if an investor in Russia were to have taken a loan for 1000 euro in June of 2021, he would effectively have borrowed 90,000 ruble. In March of 2022, due to the fall of the rubel, that debt would have increased to 130,000 rubel, not including interest.

Increased debt is bad enough, but in the case of Ukrainians fleeing to safety, there isn't time to concern oneself with bills. You pack up your basics and you make a run for the border, or the countryside, or wherever the bombs aren't landing. The likelihood of such loans defaulting increases significantly, and the collections process can be fraught with controversy, particularly when tragic loss of life is involved.

Sanctions and the Marketplace

Official Sanctions

Several countries have responded to the invasion of Ukraine by imposing sanctions against Vladimir Putin, his inner circle, and related Russian entities. The United States immobilized the assets of Russia's central bank, effectively confiscating hundreds of billions of dollars. The UK and EU joined in, blocking certain banks from utilizing the Society for Worldwide Interbank Financial Telecommunications (SWIFT). As a result, nearly a trillion dollars were frozen. To comply with those sanctions, Visa and MasterCard suspended activity with certain Russian banks, making it impossible for investors (including peer-to-peer investors) to withdraw funds linked to such cards.

Several countries outside the EU also announced they would respond with sanctions. Japan froze the assets of several individuals within Putin's inner circle. Australian Prime Minister Scott Morrison announced that he would work alongside the United States on the matter. Taiwan imposed its own sanctions on Russia, which, according to the Ministry of Foreign Affairs, were designed "to compel Russia to halt its military aggression against Ukraine."

"Unofficial" Sanctions

While official sanctions are imposed by countries and international authorities, global crises also entail what one might call "unofficial" sanctions. Whether in solidarity with the aggrieved, to make a political statement, or simply to protect corporate interests, companies often pull their resources from areas of extreme conflict. In the time since Russian troops entered Ukraine, no fewer than 15 organizations have announced plans to withdraw some or all activity with their Russian counterparts. FIFA and the IOC announced plans to bar Russian athletes, and Apple announced they would cease all product sales and limit subscription services.

A major hit to the Russian economy came soon after, when oil giants Shell and BP announced they would divest from their Russian partners, and then Maersk, a major shipping line, announced it would halt shipments to "all Russian gateway ports." General Motors, Volvo, Mitsubishi, and Renault were among the automakers to announce actions against Russian. Airbus and Lufthansa joined the growing list of transportation-related boycotts. Similarly, UPS and DHL suspended all delivery services.

The Effects on the P2P Market

Whether the money belongs to the lender, the borrower, the P2P platform, or the loan originator, it's an obvious fact that the inability to move assets endangers the lending market. When a borrower can't repay a loan because the credit card company won't process the payment, what options are left? When a lender can't receive a payment for the same reason, how is the company to stay afloat? To be clear, this is not a political argument against sanctions, rather a technical observation about the effects of sanctions on the market: The lending business relies on liquidity, and when that's absent the lending market suffers.

Investments: Credit versus Tangibles

A further hit to the lending market comes from the focus on tangibles in times of crisis. As a general rule, people don't invest in the lending market when things are unstable. They worry the currency might crash, the borrower might disappear, or their own assets might be frozen. During tense times, many people choose to invest in tangibles like gold, drawing potential funding away from the credit business. People also tend to hoard cash so they have emergent funds, rather than a meaningless number in a now deactivated account. Those with large sums to protect are more likely to purchase cryptocurrencies, as evidenced by the sudden run on Bitcoin.

How P2P Platforms have Reacted

PeerBerry

Some peer-to-peer lending platforms have reacted to current events by limiting activity in the effected areas. PeerBerry, an industry leader included in P2PIncome's list of best European sites as well as our sample investment portfolio, has frozen all activity in both Russia and Ukraine. In an email to investors, the site explained that "no loans from Russian and Ukraine will be listed on the PeerBerry platform, and only repayments will be implemented" in accordance with the terms and conditions of the site. The email goes on to clarify that PeerBerry's business partners had been "preparing for this situation" for quite some time and had "accumulated significant reserves in banks in the EU."

Iuvo Group

When the conflict broke out, Iuvo Group had to move quickly, because in addition to its lending activities it offers currency exchange and personal banking options. To prevent a total meltdown, the platform posted "Measures regarding the situation in Russia - Ukraine," in which it delineated the steps it had taken to mitigate the crisis. They removed "all available investment loans" from the Russia-based loan originator Kviku. They "temporarily suspended" the "import of new loans" from them, as well as payments from current Kviku loans. They also suspended the use of the ruble on their currency exchange. Interestingly, they didn't suspend activity on their secondary market, and one "will be able to buy/sell Kviku loans" there.

Robocash

In contrast to the sites shutting down activity in the region, RoboCash CEO Sergey Sedov, and Deputy CFO Grigorii Shikunov held a live-chat during which they explained that their activities were insolated from the conflicts:

"Neither the Robocash platform itself, nor its loan originators (none of which are based in Russia) have any relationships with Russian banks. All related transactions, as well as loan disbursement activities of the companies are done through the respective local banks. Therefore, we assure you that none of the money invested on Robocash is in any way transferred to or from Russia, and is not affected by any political tension and resulting sanctions."

They went on to explain that Robocash "is owned by EU entity AS RCG which is further owned by the Singapore entity. Shareholders of Robocash Group as UBO have nothing to do with sanctions as we are not politically exposed persons and not subject to any sanctions."

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Consumer Loans

Average Returns

12 - 13%

Minimum Investment

EUR 10

Signup Bonus

EUR 5

Registered users

30,000

Total funds invested

EUR 554 Million

Default rate

2%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Read about Robocash a Peer-to-Peer lending platform that is completed automated. Robocash offers a 12% IRR and loan requests from borrowers around the world. Robocash is a great platform for a passive investor.

What Should I Do with My Money?

If you have funds currently tied up in a p2p platform affected by the turmoil in Ukraine, you're best served to contact their customer service representatives to find out what can be done to protect your assets. All of the reputable sites have excellent customer service,

Given the responses given by the sites above, PeerBerry, Iuvo, and Robocash, there's a good argument to be made for turning to them. Of the three, our strongest recommendation goes to PeerBerry. This is a world-class site with a justified reputation for profits and gains. Investors enjoy yields of 9% to 12%, a buy-back guarantee on all principle, and even a 10-euro sign-up bonus. The loan terms range from 4 months to 120, and there are no fees.