Monthly Report Dec 2021 Entry #12

Please read P2PIncome's most recent investment-portfolio report for 2025.

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

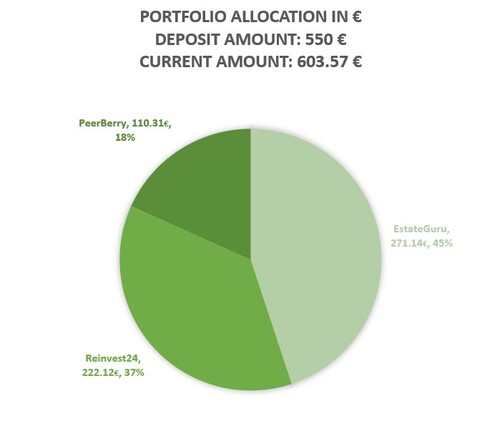

The current portfolio breakdown:

We continue into December with Reinvest24 in the top position. Reinvest24 has been in the top position for the last seven months. PeerBerry has stayed in second followed by EstateGuru at the bottom of the three in terms of performance. EstateGuru, for the last five months, has had two loans in late payment. In terms of transparency, notifications, and progression, we find that EstateGuru does not hold a candle to either PeerBerry or Reinvest24.

ReInvest24

We have been overall impressed with Reinvest24. They are the newest platform featured in these monthly reports. Their yield was 14% which lead us to believe they would be our high risk platform. We did not perceive they would be our highest performers and we have grown even more fond of the concept of their business. We have been in touch with their team on several occasions and even got a chance to speak to their CEO for an interview.

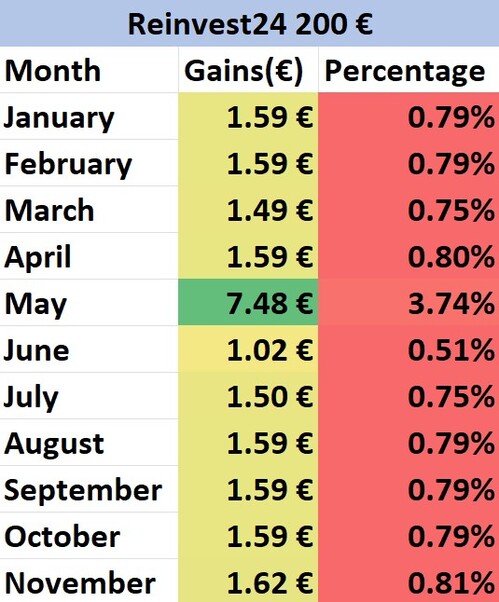

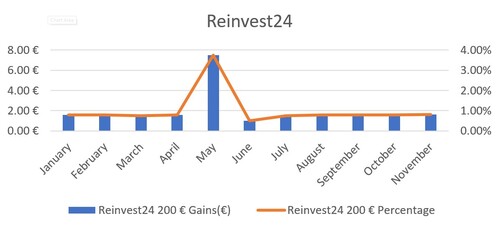

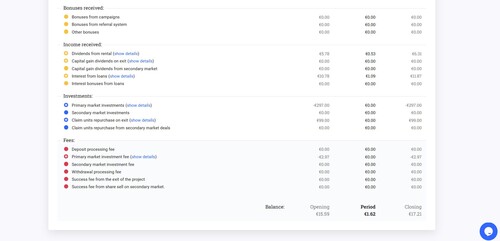

Starting Amount: € 200

After 13 Months: € 216.36

Total Percentage Increase: 8.18%

Reinvest24 is the product fintech innovation of tomorrow. The platform uses a peer-to-peer lending model to help renovate and rent property that are located in up and coming neighborhoods all around Eastern Europe. The property brings together real estate rental companies and retail investors in order to bring an ample amount of capital to communities in Eastern Europe that desperately need it.

The fascinating thing about Reinvest24 is that instead of selling standard loan contracts they provide real estate equity in exchange for capital. On most peer-to-peer lending platforms it works as follows: you provide the loan, you get some form of security, and then you're paid back. This is not the case on Reinvest24. Reinvest24, gives you equity of the actual property which means you're subject to both the risks rewards of being a property owner. If the value of the property decreases so does the equity, and if the value increases, then again, so does the value of the equity. Other than receiving capital gains on your equity, you also receive rental payments every month.

The team behind Reinvest24 are great at keeping investors informed, whether through email or through their telegram chat group where they are frequently available. Reinvest24 plans all of their real estate projects to be sold so that the equity of the property increases. As investors, you have the option on Reinvest24 to simply hold your capital in for as many years as you're comfortable with so that you can enjoy part of the rental dividends and also gain from the capital increasing every time the team successfully sells the property. We were able document one of these increases in capital gains on Reinvest24's platform that you can see in our sixth and seventh monthly report.

Marketplace

Perhaps the only downside we would share about Reinvest24 is their marketplace is fairly small. The platform is still in it's nascent stage — marketing to investors as often as it can. But its arrival to the alternative lending space was late and their concept is still rather foreign. Despite our positive views on Reinvest24's service we can understand why someone would choose an inferior yet familiar more traditional form of peer-to-peer lending.

We are very pleased with the consistency as well as the fulfillment of Reinvest24's promise.

PeerBerry

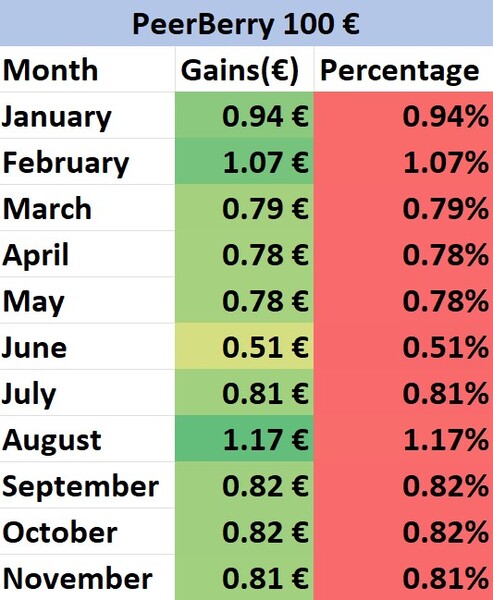

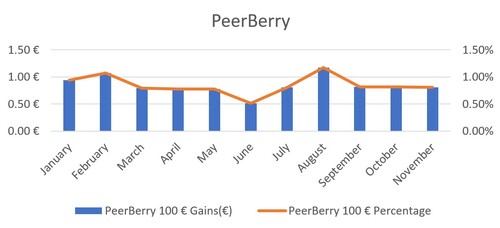

PeerBerry was designed to keep investing simple, safe and profitable for their investors. PeerBerry stands out from the of its competitors for a few reasons. The platform has certain features that enhance its resistance to money loss. For example, PeerBerry has many different loan types, some with collateral and some without. Meaning investors have a wide range of investments and can easily diversify on PeerBerry. PeerBerry has a two layered buyback guarantee which protects all investors and borrowers in PeerBerry's ecosystem.

Starting Amount: € 100

After 13 Months: € 108.71

Total Percentage Increase: 8.71%

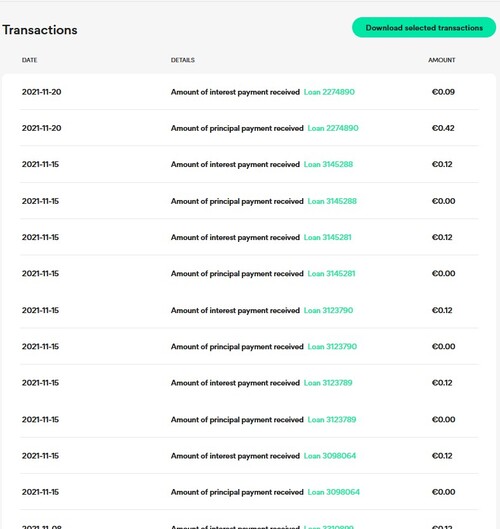

Lending and borrowing in PeerBerry is a smooth process for all parties involved. Investments start from a small requirement of 10 EUR and the yearly interest ranges from 9 to 13 percent. PeerBerry has a sophisticated auto-investing tool which many investors find simple and intuitive. We find PeerBerry to be a great platform. Their projected returns for our investments are almost identical to that of the end result. PeerBerry has very little cash drag and the scheduled pay outs are always on time and in the right amount. We have found that PeerBerry generally brings in rates between 0.79 to 1.00 EUR.

PeerBerry is definitely more transparent than most companies. All loan originators must disclose their financial reporting, and PeerBerry's team is always available for discussion on their telegram group. We were also able to get in touch with PeerBerry's CEO, Arunas, who paints an interesting and vivid picture of PeerBerry and its future. It would be important to highlight Peerberry's buyback guarantee is a level above every single other buyback guarantee out there. It features two layers, with the first one protecting any investor from a defaulting borrower, and the second layer guarantees that if a loan originator starts to go bankrupt, the rest of the system would pool together resources to uphold the system and maintain the ecosystem itself.

Marketplace Review

What's interesting about PeerBerry's marketplace is how they diversify the loans. Many platforms have two marketplaces, a secondary and primary. PeerBerry does not, instead, they offer very short term loans that finish within 30 days for investors who are in need of liquidity when investing.

The nicest thing about PeerBerry is how quickly their auto-invest begins to function. As soon as a loan is finished it is re-invested the next day. There is also very little cash drag because loan amounts on PeerBerry are reasonably small and liquidity is high.

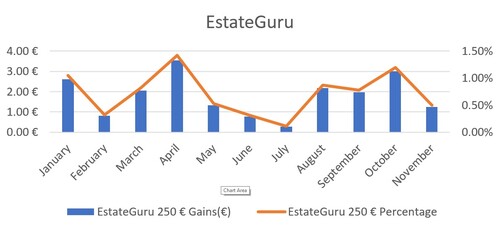

EstateGuru

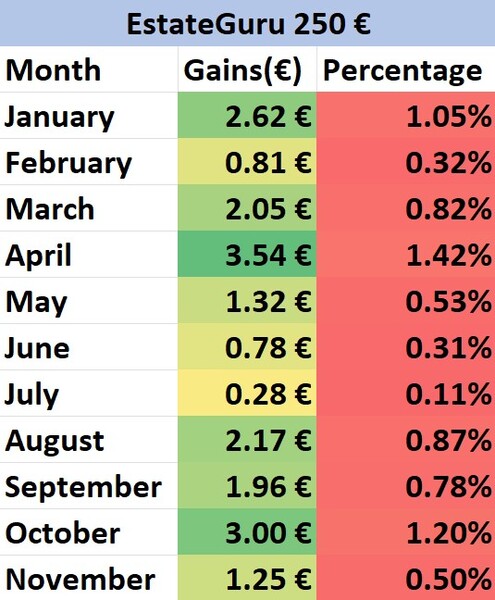

Out of the three platforms in this monthly report, EstateGuru is by far the largest. They have funded more projects than both platforms and have been around twice as long as both Reinvest24 and PeerBerry. EstateGuru basically dominates the real estate peer-to-peer lending market in Europe. They have a favorable reputation, to their credit, EstateGuru has never lost capital for their investors. Perhaps our portfolio will be the first but time has yet to tell.

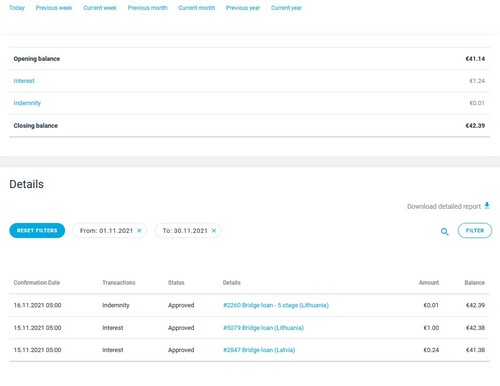

Starting Amount: € 250

After 13 Months: € 264.88

Total Percentage Increase: 5.95%

It is pretty disappointing to see EstateGuru, such a favored platform, under-perform and do the minimum to make up for it. These two loans have been late for so many months it's shocking. The borrowers appear to simply be paying back a little bit of interest, keeping the loan late but not defaulted. EstateGuru continues to suggest that the borrower is going to be able pay back and will, mean while, every time the borrower pays a bit of interest, EstateGuru resets it's amount of days late. So these borrowers have been keeping the loan late, paying the minimum interest possible and not defaulting. We cannot recommend this kind of investing.

Marketplace Review

EstateGuru's marketplace appears to have slowed down a bit. The secondary market is still very active with investors constantly buying and selling loans. The fee on the secondary market has a fluctuation between 1 and 2 percent.

We are waiting for our borrowers to pay back a bit more before we sell our loans on the secondary market and exit our position.

Comparing Platforms

Reinvest24 has held the torch for several months because of the innovation their service provides. This concept of holding equity as opposed to simply being in a loan contract is genius. It allows for far more revenue to be made, it provides liquidity to a market that desperately needs it. Investors have the option to leave their investments growing without needing to reinvest, that is to say, investors can purchase equity and hold it for as long as they wish. Constantly benefiting from both rental yields and equity gains. PeerBerry is a great platform, with a security feature that is unmatched by the rest of the peer-to-peer lending systems. EstateGuru has largely been a disappoint and at this point we wish to be done with them.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 22.12 | 11.6% |

| PeerBerry | € 100 | € 10.31 | 10.31% |

| EstateGuru | € 250 | € 21.14 | 8.45% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

The gap remains the same between the three platforms. PeerBerry is closing in on Reinvest24 but it can never quite reach. Our recently purchased development loan also appears to be performing well, and we have been paid full every time according to schedule. We are certainly advocates of PeerBerry but Reinvest24 yields more money.