P2PIncome | Top Lending Platforms For Low Fees

No matter which asset class you're investing in you're going to realize that fees can really eat up a huge part of your portfolio. Many peer-to-peer lending platforms understand how much the word "fees" can be unappealing to many investors. With that in mind, many platforms have opted to have marketplaces with little to zero fees to ensure that investors don't feel that they were cheated by the platform.

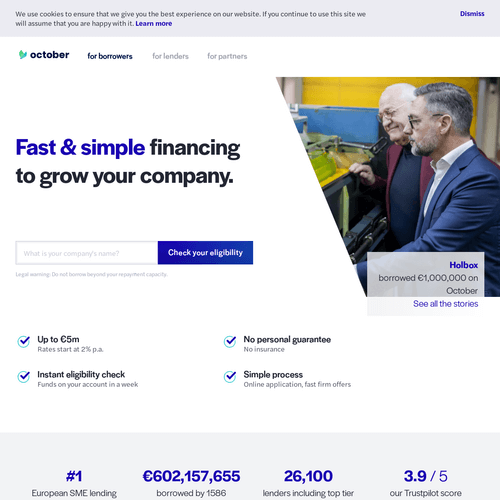

October

October is a peer-to-peer lending service focusing solely on European business. October is partnered up with the EU as their objectives are in alignment. October wishes to make Europe a better place to do business. They feel that their service simply provides an extension to society that allows business owners another way to get their hands on capital.

October's entire business model revolves around funding legitimate businesses and reducing all forms of risk. Borrowers undergo extensive checks before they are able to issue loans and investors are also bound to rigorous checks to ensure they know what they are doing on October's platform. If you're interested in learning about platforms like October that never lose investors' money, read our guide on P2P platforms with low default rates.

October has been around since 2014, in terms of peer-to-peer lending platforms this is a relatively long time. The business lending platform has close with financial EU institutions to ensure that the European economy October is funding is done properly. October has a 20 EUR minimum deposit but upon depositing, investors receive a 20 EUR bonus. Yearly interest rates range from 3 - 7 percent, the interest being very low in comparison to the market. However, October backs up their low interest rates by providing the risk free investing and dedicating rigorous amounts of resources to risk and asset mitigation. October has absolutely zero fees.

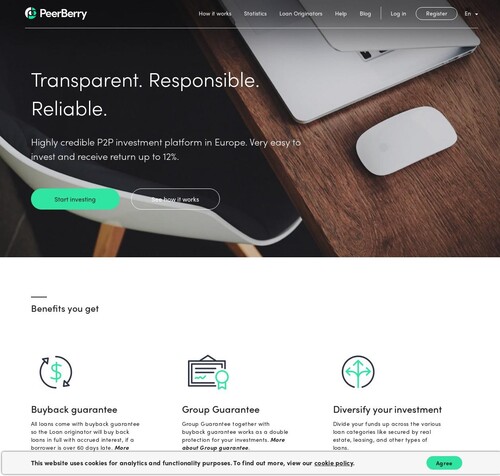

PeerBerry

PeerBerry is a loan originator aggregator which means that they give multiple loan originators a marketplace to advertise their loans. Investors then come and partake in the loan originators lending business. PeerBerry is considered one of the fastest growing peer-to-peer lending platforms. This is most likely because Peerberry is a state of the art peer-to-peer lending application. Their business model comes with great features that make investing with PeerBerry a pleasant experience. To invest on PeerBerry, there is a 10 EUR deposit requirement and yearly returns range from 9 - 12 percent.

PeerBerry's marketplace is always moving. Whether it's new investors, new loans or updates to their platform, PeerBerry is always an exciting place to invest. There are absolutely zero fees associated with investing in PeerBerry. PeerBerry was founded by a very successful lending organization in Europe called Aventus Group. Aventus initially used Mintos to issue loans to retail investors but shortly after recognizing Mintos' success they decided to create PeerBerry. Retail investors have so far loved PeerBerry due to it's very specific approach to peer-to-peer lending.

PeerBerry uses a dual buyback guarantee which ensures both the borrowers and the lenders on the platform that they are all in this together. All the loan originators essentially have each others back to ensure that the investors are not going to lose capital. There are a lot of different types of buyback guarantees and other ways of protecting capital. You can read more about that in our investment guide on buyback guarantees.

PeerBerry also has a fully customizable auto-investing tool which allows their investors to optimize their strategy until they find the types of loans they desire. All loans on PeerBerry are also backed by collateral so in the case of a defaulted loan there is always a piece of property that can be sold off. PeerBerry itself is incredibly transparent and it is possible to find all of their financial statements, as well as the financial statements of the loan originators operating on their platform.

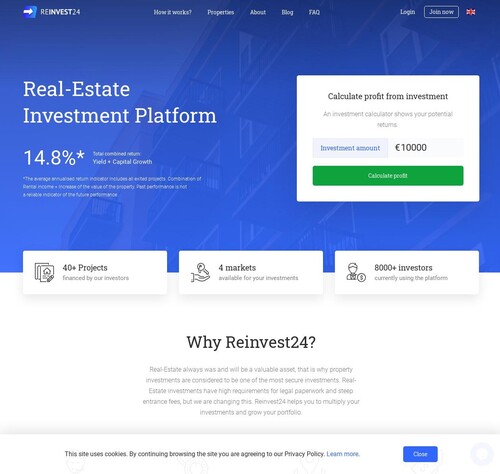

ReInvest24

Reinvest24 is a new approach to investing in real estate that reduces risk, and promises income. In Reinvest24, investors temporarily purchase partial real estate equity and receive part of the rental as a return until the loan is repaid. Investing on Reinvest24 has a minimum requirement of 100 EUR and yearly returns are roughly 14 - 15 percent. Reinvest24 has both a primary and secondary market with many high yielding projects.

While some loans span 4 months other can reach up to two years. During this time, the value of the actual property can fluctuate both upwards and downwards. Reinvest24 has a relatively slow marketplace, they do not offer a lot of loan offers and when loans are offered they can take some time to be funded. Reinvest24 is still quite a new platform, therefore, such things can be expected. Reinvest24 has both a primary market and secondary market on their platform. In the first marketplace, investors will find bullet loans, development loans and rental loans.

Once loans are funded and processed then the gains on Reinvest24 are considerably high, certainly higher than the majority of mortgage lending platforms. The platform has both a primary and secondary market so that investors always have the option to cash out or switch to loans that they feel have a higher chance of earning more. In general, there are two forms of earnings of Reinvest24, rental dividends and capital gains. Since investors are purchasing ownership rights of the properties they are lending money to, they can also potentially reap benefits from property value appreciation. Unfortunately, property value can also decrease, depending on the current economic situation of the given country Reinvest24 is lending capital too. Reinvest24 is fee-friendly, with all investments simply have a 1 EUR fee which depending on the size of your investment, it can be unbelievably cheap.

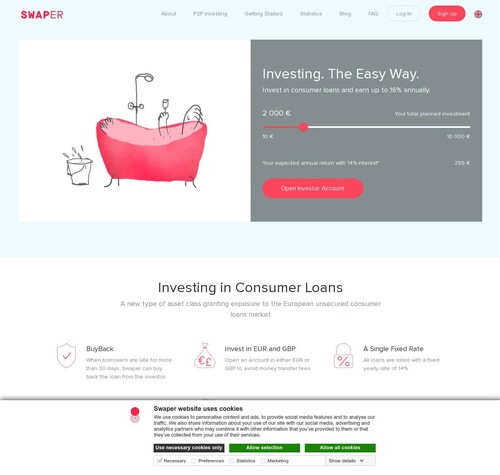

Swaper

Swaper is an auto-investing solution for investors who are less interested in reading and researching what they are investing into. Swaper guarantees investors that they can optimize their auto-investing tool or manually invest, but either way, they will make 14%. To invest in Swaper there is a requirement of 10 EUR minimum deposit.

It is not possible to manually invest in Swapers primary market. Swaper is a hands off approach to investing, that being said, it is possible to sell and buy loans in Swapers secondary market. Swaper has a very active secondary market which serves their investors liquidity needs. Furthermore, Swaper has absolutely no fees on their platform making them a very appealing investment platform for peer-to-peer lending investors.

Swaper was founded by their sole loan originator and parent company, Wandoo Finance. Wandoo is a leading lending organization, based in Europe, that is focused on providing fintech solutions around the world. Since the creation of Swaper, it has been sold to Marina Tjulinova. She is the current owner and head of business operations at Swaper. Our sole concern with this platform is it's reliability on Wandoo Finance. Although, Wandoo issues all of the loans to Swapers investors, and Swaper is liable for all of the buyback guarantees.

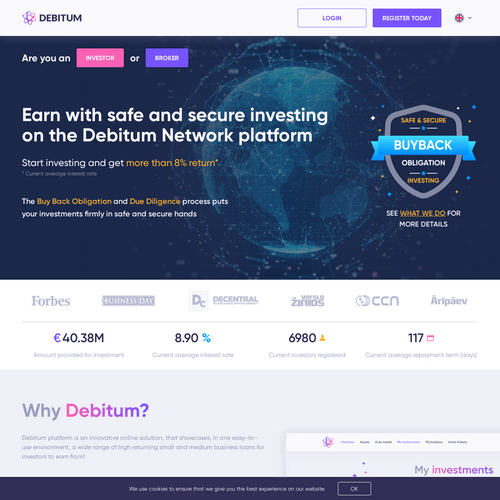

Debitum Network

Debitum is a peer-to-peer lending platform in Lithuania that helps to provide business owners with liquidity solutions. Debitum is a loan originator aggregator which primarily focuses on businesses with a fixed amount of capital in their accounts receivable. These businesses before receiving their income, need capital to function. The loan originators who operate on Debitum issue loans to these businesses, knowing for a fact, they have income that is redeemable. These business loans are then offered to retail investors.

Debitum initially began as a company that would use both fiat peer-to-peer lending methods and cryptocurrencies to establish a hybrid platform. This lead to some controversy among many investors because while Debitum's fiat program is progressing and expanding, their cryptocurrency appears to be failing. Considering the headway Debitum has made so far, it is difficult to determine their cryptocurrency as valueless. The token has it's place in their ecosystem as part of their rewards system.

To invest in Debitum there is a 500 EUR minimum investment entry and yearly returns range from 8 - 9 percent. The platform has had zero defaulted loans, relatively high returns and zero fees. If you're interested in reading more about peer-to-peer lending and business loans, you may refer to our guide on investing on business loans.

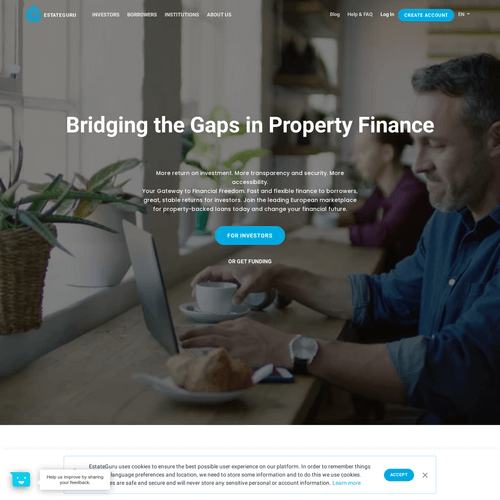

EstateGuru

EstateGuru is a top tier peer-to-peer lending platform. EstateGuru offers their investors a yearly return of 9 - 12 percent at a minimum investment of 50 EUR per investment. EstateGuru holds the number one position in Europe in terms of loans, investors and projects for crowdfunding based real estate platforms.

EstateGuru is a well-known platform with an impeccable track record. The platform has had zero defaulted loans. All loans are backed by either a 1st or second rank mortgage in the case of any problems, there is always property to sell and reimburse investors. Investors principal is always protected on EstateGuru, on top of this, the platform has zero fees. Making it a very attractive marketplace for investors to earn. EstateGuru also has an auto-investing tool which can be used on investments above 250 EUR and a secondary market, which is highly active.

EstateGuru's only fees are a 2% transaction fee on the secondary market. All property related platforms can experience some cash drag in comparison to personal loans or business loans. By and large, property development can be a lengthy and expensive ordeal, which means, investing on EstateGuru may result in a bit of cash drag.

Mintos

Mintos is the largest peer-to-peer lending platform in Europe. By having funded well over 5 billion EUR, they have exceeded the other European P2P lending platforms by almost tenfold. Mintos was founded in Riga, Latvia in 2015 but only found real, explosive growth in the year 2017. Mintos utilizes a loan originator aggregating system in order to manage and facilitate their lending-borrowing ecosystem.

Loan originators are local lending organizations that issue loans to borrowers. Prior to peer-to-peer lending, there was only mortgage loan originators, who were individuals who would assess and provide loans to borrowers who wished to purchase a piece of property or real estate. Loan originators today can provide loans for any purpose, for business, personal reasons or mortgages. Mintos aggregates a number of loan originators on their platform to provide users the option to invest in a diversified number of loans. Other than a 2% fee to use Mintos' secondary market, Mintos has zero fees.

The loan originators on Mintos are judged based on certain criteria determined by Mintos. This criteria has to do with the loan originators' track records, popularity on Mintos' marketplace and reliability of the loan originator. Depending on the criteria, they receive a rank. Loans that are A ranked are low risk and loans are that C rank are high risk. Mintos has multiple auto-investing packages that will allow you determine the type of you risk you would like to take, which will in turn indicate the kind of reward you will receive.

Market Type

Business Loans

Average Returns

3 - 7%

Minimum Investment

EUR 20

Signup Bonus

EUR 20

Registered users

43,000

Total funds invested

EUR 1 Billion

Default rate

3%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Card, Bank Transfer, TransferWise

Withdrawal methods

Bank Card, Bank Transfer, TransferWise

October specializes in small risk business loans specifically to SME's in Europe. October has a great track record of fund recoveries, a solid mission and a very strong foundation. October's business and risk strategy is worth the time to read.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

1%

Registered users

500,000

Total funds invested

EUR 8.9 Billion

Default rate

16%

Regulating entity

Financial & Capital Market Comission (Latvia)

Buyback guarantee

Secondary market

Payment methods

PayPal, Bank Transfer, Credit Card, TransferWise

Withdrawal methods

Wire transfer, Credit Card

Mintos is P2P loan originator aggregator whom after years of slow growth exploded and became the number one P2P lending platform in Europe. Find out why in this review. Is Mintos an investment worth considering?

Are Zero Fees Good for Everyone?

It is a good idea for platforms to have minimal fees for investors? In order for platforms to afford the highest grade security, to attract the highest loans, and to hire the best people, they require ample amounts of capital. Where do they receive the capital if not from the investors? They receive it from the borrowers?

We are not convinced that only charging the borrowers is an ideal situation, after all, they are the ones borrowing money. The old adage, you get what you pay for isn't simply an adage. If platforms are expected to grow and scale all while maintaining their security they need to be financially stable. We understand the appeal behind investing in a platform with zero fees, but is it the ideal place to invest?

If the peer-to-peer lending platform you're already investing into has zero fees then you should make sure you do your due diligence to ensure it's not just another ponzi scheme. Zero fees are a wonderful thing for investment growth and yield, but it should come under severe scrutiny.

Verdict

Ultimately, having less or no fees is a good thing. If you can ensure that your investment can grow at a reasonable APY without having to encounter any fees you will be well on your way to some serious gains. That being said, as investors, we have to take a look at our surrounding environments. Most peer-to-peer lending platforms charge a fee for selling and buying on the secondary market. That is too be expected. In general, we believe that the best platforms are the ones that do take minimal fees to ensure that the companies themselves can keep on operating.