The Best P2P Lending Sites for Investors in Estonia

On the eastern coast of the Baltic Sea, nestled between the Gulf of Finland to the north, Latvia to the south, and Russia to the east, lies the small Finnic country of Estonia. The republic broke off from the Soviet Empire in 1991, and was accepted into the European Union in May of 1999. In the years that followed, the Estonian Government sought ways to bolster the new republic's economy, including coining its own currency (the kroon), instituting a 26% flat tax (later reduced to 21%), and providing incentives to start-ups. Banks and lending platforms quickly popped up all over the tiny country, and within a few years Estonia had become a major hub for p2p lending, with several of the world's top-tier platforms housed there.

In this edition of our ongoing By Country series, P2PIncome's financial experts discuss the best p2p-lending platforms for investors living and working in Estonia. All of these platforms are either housed in Estonia, or have active loan originators therein.

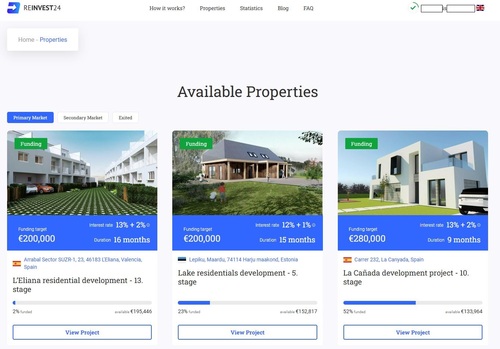

Reinvest24

Investing in real-estate projects is a great way to earn passive income. The interest rates tend to be attractive, with most peer-to-peer real-estate lending platforms charging between 10% and 12%. In addition, many of these loans earn rental dividends for years after completion of the project. The rental dividends are proportionate to the investment, so if you've invested in 0.5% of the project, you're entitled to 0.5% of the rent collected (minus any fees). If and when the project is sold, you are entitled to any capital gains generated by the sale. These, too, are proportionate. Reinvest24 is among the very best platforms for such investments, with hundreds of active contracts on the primary and secondary market.

As one of the platforms covered in our investment portfolio, the experts at P2PIncome have had plenty of time to familiarize ourselves with Reinvest24. The platform excels in its field, offering average quarterly returns of 2.25%, or 9% per annum. The volume of available projects means you'll never have to wait long to reinvest your profits, and the active secondary market facilitates liquidity. Many of the projects are in Estonia, and because every listing includes an address, local investors can take a short trip to the project site. They can also take comfort in the fact that they're helping the local economy.

The minimum investment on Reinvest24's primary market is only 100 euro, making it readily accessible to most investors. The minimum on the secondary market in one Claim Unit, the value of which differs for each listing. As you peruse the Reinvest24 marketplace, you'll find all the information you need readily available. The listing includes the Funding Target, the Interest Rates, the Duration of the loan, the Success Fee, and so on. You'll also find high-definition photographs and renditions, as well as an overview of the surrounding area, the property, and the project.

Iuvo Group

Iuvo Group is an Estonian peer-to-peer lending and online-banking platform. Users can invest in consumer loans originated by a long list of European loan originators, including Bulgaria's EasyCredit and VivaCredit, Romania's iCredit and Fast Finance, and North Macedonia's M Cash and SN Finance. In addition, users can deposit money into a high-yield savings account, with interest rates ranging from 5% to 7% (per annum), depending on the duration of the deposit. The savings program has a minimum deposit of 100 euro, and the p2p investment minimum is a mere 10 euro.

The low minimum investment on Iuvo Group makes it an excellent platform for those just starting out in p2p lending. With just 200 euro, for example, you can invest in 20 different loans, thereby diversifying your risk profile and reducing variance. To help you determine risk, Iuvo-Group assigns each loan a Score Class, ranging from A to E, with A being the best possible score. There's also a category of loans labeled "HR," meaning high-risk, which could have just been labeled "F," but it seems "HR" draws more attention to the severity of risk. Regardless, Iuvo-Group guarantees 100% of the principle investment, meaning you're mostly risking your time and effort (opportunity cost).

Listings on Iuvo-Group's marketplace range from €100 to €5000, though you'll notice many of the listings are in Bulgarian lev, Polish złoty, and Romanian leu. Users need not worry about the conversions, however, as they are performed automatically by the platform. Users on a busy schedule will enjoy Iuvo-Group's auto-invest tool, which allows you to set the investment parameters and leave the busy-work to the platform.

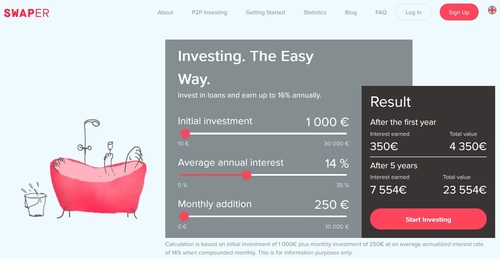

Swaper

Swaper was founded in the Estonian capital of Tallinn, in 2016, by financial "guru" Marina Tjulinova, who also servers as the platform's Head of Operations. Swaper lists short-term unsecured personal loans ranging from €50 to €1500, and interest rates averaging 14% using their auto-invest tool. Swaper offers one of the best mobile apps on the market, meaning you're always a few taps away from an important financial decision.

Swaper started out as a wholly-owned subsidiary of Wandoo Finance, which continues to serve at Swaper's primary loan originator. Marina Tjulinova started out as CEO, but moved to Head of Operations when Indrek Poulokainen was appointed CEO. Oddly enough, as of 2022 Marina was also the direct owner of the company. Nevertheless, Poulokainen is the only board member listed on the Estonian register, meaning Tjulinova's ownership doesn't have a direct influence on the company's operations.

In addition to its marketplace, Swaper publishes scores of blog articles. Users interested in learning more about p2p lending and general finance should frequent the blog. You'll find monthly reports on the progress of the company, as well as quarterly and annual reports. There are articles on how investors should manage fees and taxes, as well as financial guidance for those investing in real-estate. You'll also find advice about portfolio management and how to hedge against inflation. Swaper also offers a 2% bonus to users who invest more than €5000.

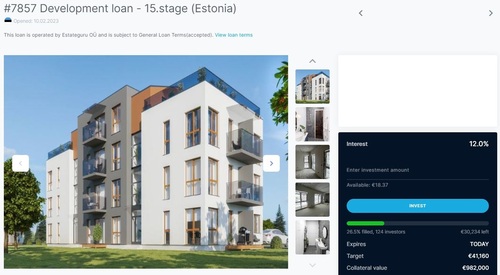

EstateGuru

There are several excellent p2p real-estate investment platforms, of which EstateGuru ranks among the very best. The platform boasts an enormous marketplace, with properties all over Europe, including Estonia, Finland, Latvia, and Lithuania. The listings include everything from bridge loans to long-term development loans, with loans starting at €5000 and peaking at €2,000,000. The interest rates range from 8% to 12%, not including bonuses.

EstateGuru has one of the largest real-estate marketplaces in p2p lending. There are hundreds of listings at various phases of development, from small bridge loans to substantial funding projects. On any given day, you'll find loans ranging from €25,000 to as much as €2,000,000. To be sure, you don't need to invest more than €50, which means there are plenty of opportunities to diversify your portfolio based on LTV, Interest, and loan Type. You can find all of those data points included in each listing.

The secondary market on EstateGuru is also quite active, meaning you're never "stuck" with an investment if your circumstances change. You'll find investment opportunities for as little as €5 and for as much as €25,000. EstateGuru also offers an excellent Auto-Invest tool, which you can configure in one of 3 ways: Custom, Conservative, and Balanced. Each comes with its own LTV setting, and while the Conservative setting excludes certain countries, the Balanced includes all loan types. Obviously, the Custom option lets you decide all of the parameters for yourself. You can even allocate a certain amount of money to Keep Uninvested.

Our Recommended P2P Lending Sites for Investors in Estonia

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

8 - 10%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

36,000

Total funds invested

EUR 370 Million

Default rate

8%

Regulating entity

Estonian Financial Supervision Authority

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Trustly, Paysera, Revolut, TransferWise, ePay

Withdrawal methods

Bank Transfer

Iuvo is an award-winning P2P and personal-savings platform based in the Republic of Estonia and regulated by the Estonian Financial Supervision and Resolution Authority. The platform is well-funded, and works with several loan originators to market personal loans ranging from 1000 to 2500 EUR.

Market Type

Consumer Loans

Average Returns

14 - 16%

Minimum Investment

EUR 10

Signup Bonus

None

Registered users

6000

Total funds invested

EUR 400 Million

Default rate

Undisclosed

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer

Withdrawal methods

Bank Transfer

Swaper only offers auto investing in unsecured consumer loans in Poland and Spain. Swaper is a subsidiary of Wandoo Finance Group, a loan originator that also services the loans on Swaper's platform. Swaper advertises a 14% IRR and premium investors who have invested over 5000 EUR receive an IRR of 16%.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

The platforms covered here are all successful peer-to-peer lending platforms founded in Estonia. They're all excellent p2p platforms, offering good returns on a long list of investments. That can make it difficult to choose just one, which is why the experts at P2PIncome provide this verdict. Our top recommendation for Estonian investors is Reinvest24, because it offers the investors the highest average return on investment, per annum, without the risk associated with personal loans.