Monthly Report Oct 2021 Entry #10

Please read P2PIncome's most recent investment-portfolio report for 2025.

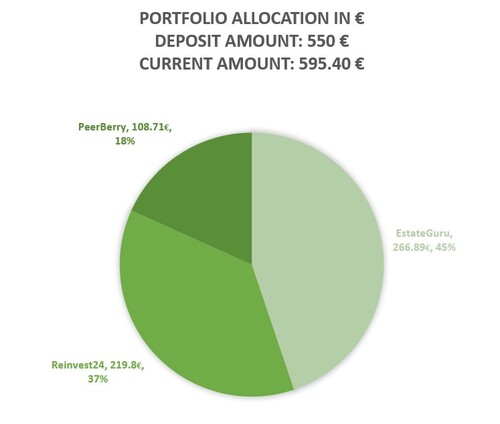

Welcome to our monthly report on P2P platforms, where we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are, Reinvest24, PeerBerry and EstateGuru.

The current portfolio breakdown:

September brings a normalcy of returns to our earnings on EstateGuru. Finally, we are seeing at least a few EUR return each month. For the past 6 months the returns we have received from EstateGuru were drastically lower than that of PeerBerry and Reinvest24. We have two loans on EstateGuru that are still late and the borrowers, although they have promised to pay back, have yet to do so. PeerBerry and Reinvest24 continue to perform as expected and as they have for the last 6 months.

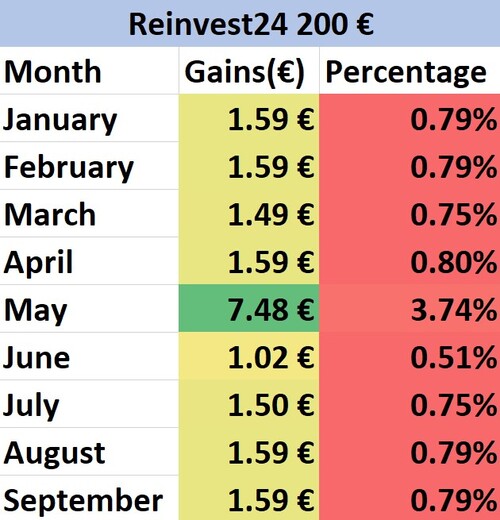

ReInvest24

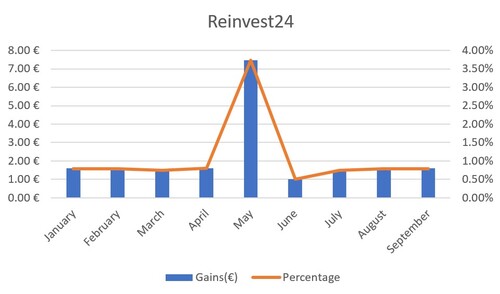

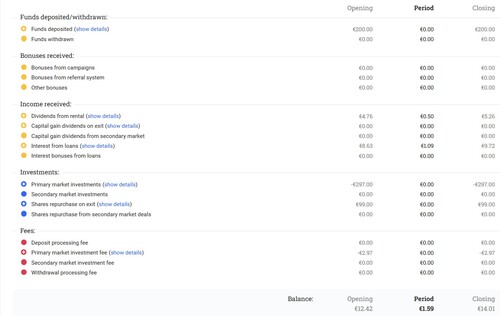

The month of September was very similar to August which can be seen by comparing our last monthly report to this one. Reinvest24 continues to pay the promised amounts on time every month. Our development loan was an 8 month contract, currently in its fourth month. It would be interesting to see if the project has a successful buyer to increase the capital gains of the property. So far, a year has passed and we definitely did not see a 13 percent IRR which was the forecast for our earnings after the fiscal year.

Starting Amount: € 200

After 11 Months: € 216.36

Total Percentage Increase: 8.18%

Reinvest24 is a peer-to-peer lending platform that sells temporary real estate equity for property financing. Rather than purchasing a loan that is leveraged on a mortgage, investors temporarily purchase the equity of the property. The properties are all predestined with a business plan and trajectory for making a profit. Retail investors like you provide capital in exchange for the temporary equity. This equity brings about two forms of profit, rental dividends, and capital gains. The rental dividends are part and parcel of the predestined business model. Each property comes with pre-signed tenants who pay an agreed upon rent that is established beforehand. The investors are privy to the potential net return of the listed properties. In this same business model, there is also a plan to sell the property and increase the value of the equity by a reasonable amount.

In regard to how capital gains are made on Reinvest24, it occurs when the team successfully executes a sale of one of the properties they are crowdfunding. When this happens, the sale makes the property increase in value and therefore, as equity holders so does the value of our holdings. The rental dividends on Reinvest24 are a smaller amount, predated and set in amount. In our experience, we have seen a very consistent return of anywhere between 0.70 - 0.80 percent in interest in our rental dividends. We currently hold "Modern offices in the business center of Talinn", this recently sold and increased in about 5 percent value. Our second holding is the "Metropolis development loan - Stage 7", it ends in four months and we are hopeful to see a sale and increase in value.

Despite Reinvest24 not reaching their yearly forecast, the yields were still very high and we are satisfied with the outcome.

Marketplace

Reinvest24's primary marketplace currently has 3 open projects and it's secondary market is full of great loans that have already been funded. Reinvest24's progress is still healthy and productive. Their platform is currently updating and making the transparency between them and their investors better. There is a bit of cash drag on Reinvest24 but that is to be somewhat expected with property crowdfunding services.

As mentioned before, we are satisfied with our portfolio activity on Reinvest24. We are hoping our development loan will rise in value as our modern offices did.

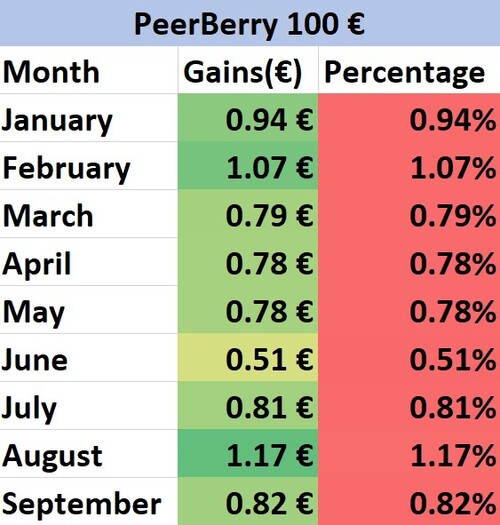

PeerBerry

PeerBerry is a very easy to use peer-to-peer lending platform. They use a loan originator aggregation model to offer loans to investors. Investments start from a small requirement of 10 EUR and returns range from 9 - 13 percent. They offer loans from all lending industries, mortgage lending, consumer lending and business lending. PeerBerry stands out from other platforms with their intense security protocol that they built their ecosystem around.

Starting Amount: € 100

After 11 Months: € 108.71

Total Percentage Increase: 108.71%

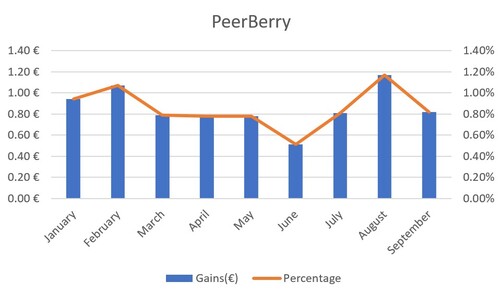

PeerBerry, like Reinvest24 has been a great, consistent and reliable investment experience. Every month we receive anywhere between 0.7 - 1 percent in interest. PeerBerry's projected yields were about 9 - 10 percent which is actually what we basically received, which is 8.71 percent. As can be seen in the graph above the pays out for PeerBerry have never drastically shot up or down, whereas, on our two other platforms featured in this report, there are both dramatic increases and decreases.

PeerBerry has an incredibly safe and secure system. There are two buy back guarantees the first one guarantees investors, the second one guarantees loan originators. The entire system is designed to ensure that all parties are profitable including the borrowers, the platform and the investors. PeerBerry can be reached on multiple platforms and have a very active communications team that is always assisting investors and creating brand awareness.

Marketplace Review

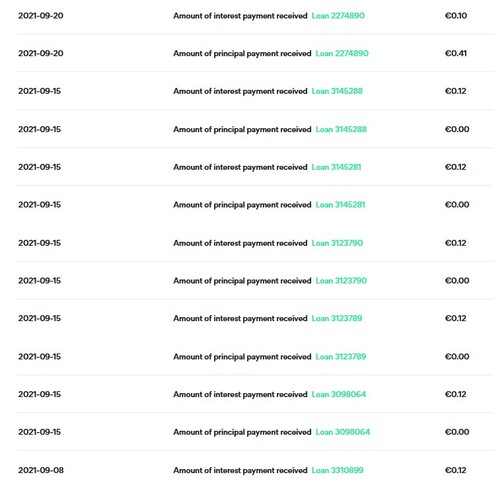

PeerBerry's marketplace is always growing and improving. Since PeerBerry's inception it has experienced explosive growth due to its realistic peer-to-peer lending profits, good value projects and prioritization of clarity and communication between the platform and their investors. There is no end to the amount of loans that can be invested in on PeerBerry. Our loans are performing as they should be, paying out in normal amounts in normal time.

Over a year has passed since we invested with PeerBerry. Out of all the platforms they have provided the most accurate reporting in terms of projected yearly return. We had zero problems, no late loans, great communication and an overall enjoyable experience with PeerBerry

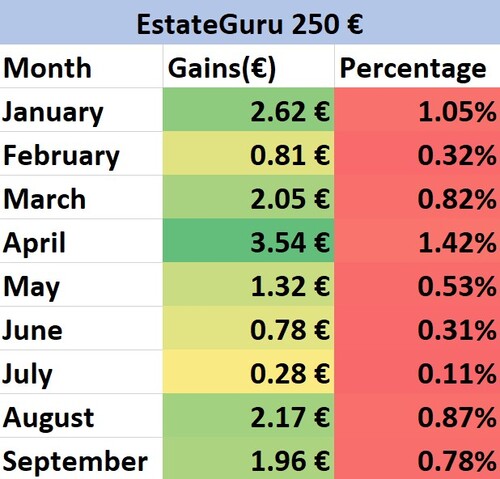

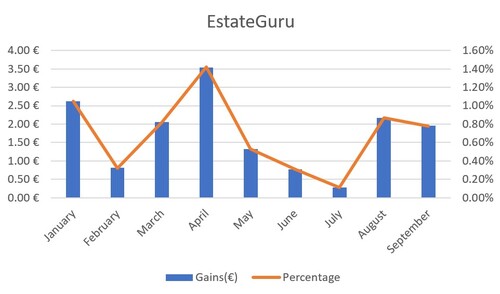

EstateGuru

EstateGuru is the largest real estate crowdfunding platform in Europe. They have hundreds of properties being processed through their platform in both Eastern and Western Europe. The platform was formed and is managed by financial and property management experts. All loans on EstateGuru come with either a 1st or 2nd rank mortgage as collateral. There is a 50 EUR minimum to invest in EstateGuru and returns range from 8 - 12 percent in yearly returns. EstateGuru has a very active secondary market which makes up for a significant portion of volume on EstateGuru. There is also an auto-investing feature that can be used on EstateGuru, there is a minimum investment of 250 EUR to utilize the auto-investment software.

Starting Amount: € 250

After 11 Months: € 264.88

Total Percentage Increase: 5.95%

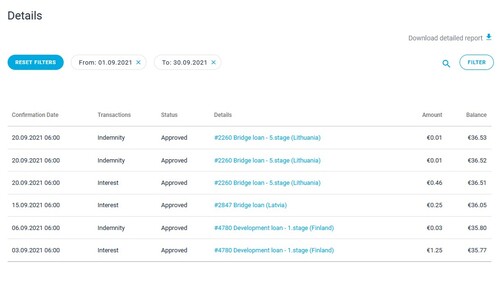

In regard to our monthly portfolio, EstateGuru has begun to start paying out regular amounts of interest. Two of our loans remain late, we were notified that there would be some kind change prior to October. We have yet to see any changes. Although EstateGuru has begun to bring interest it is still way too little. Their communications team have claimed that everything will resume as normal in their unofficial telegram channel.

Marketplace Review

EstateGuru offers a large variety of property based loans. We remain pretty disappointed in EstateGuru. There are plenty of new loan offerings being listed everyday. We are considering selling the loans on the secondary market in the case that the borrower remains late on his payments into October.

We were under the impression EstateGuru would be the least risky platform of our trio. It came at a shock to us that the two new platforms would outperform EstateGuru. When all is said and done, there is a chance that EstateGuru will yield a nice amount.

Comparing Platforms

Reinvest24 basically paid out 10 percent over the course of a year which is pretty high all things considered. EstateGuru coming under 7 percent is a sight to behold considering it was meant to yield 10 percent. PeerBerry definitely had a more consistent return. It should be acknowledged that Reinvest24 does not always sell their listed properties. In another investment cycle it's not guaranteed that our earnings would have been this high.

| Platform | Deposit | Payout | Yield |

| Reinvest24 | € 200 | € 19.80 | 9.9% |

| PeerBerry | € 100 | € 8.71 | 8.71% |

| EstateGuru | € 250 | € 16.89 | 6.75% |

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

Since may, Reinvest24 has been at the top of the lead of our monthly investment reports. Prior to that, there was a tug of war between the three platforms. After Reinvest24 sold a property, we saw a spike in our earnings from them. PeerBerry is a great platform. But in this segment of ours, we are seeing Reinvest24 outperform both EstateGuru and PeerBerry.