Credon Reviewed | First Impression of a New P2P Platform

Credon is a comparatively small peer-to-peer lending operation based in the Baltics. The company has been granted a crowdfunding license from the Bank of Lithuania. Established in late 2021, Credon aggregates and lists pre-approved short-term personal and payday loans ranging from 100 to 3000 Euro. Investors can benefit from interest rates of 9.9 to 13.5 percent, and the site also offers auto-invest and secondary market options.

Credon is a wholly-owned subsidiary of CreditOnline, which markets professional loan-business software. CreditOnline's software is used by major players in the field of P2P lending, including Mintos. This is a promising fact, as it suggests Credon will have sufficient funding to weather a few storms. In this review, P2PIncome's experts analyze Credon's pros and cons, ask the tough questions, and provide first impressions on this new p2p platform.

Types of Loans on Credon

Personal loans

Mortgages

Business loans

Car loans

Payday loans

Invoice finance

Development loans

Bridge loans

Renovation loans

Student loans

Debt consolidation

Wedding loans

REIT loans

Small Business loans

Cash advances

Credon Loan Characteristics

Loan duration1 - 6 months

CurrencyEUR

Buybacks Yes

Collateral No

Available inLatvia, Lithuania

Returns rate12% - 14%

Default Rate8%

Fees

Bonuses

Credon Features

Auto-invest

Manual selection

Secondary market

Pooled investments

Regulated

API Integration

High liquidity

Quick withdrawals

Secured Loans

Loan originators

Equity based

Credit based

Diversified marketplace

Award winning

Pros & Cons for Investors

Pros

- High Interest

- Licensed Platform

- Financial Security

- Proven Software

- Excellent Support

Cons

- Young Platform

- Clunky UI/UX

Investing with Credon

If you have money sitting around in a savings account, you're not really getting much out of it. The interest rates offered by banks are never great, especially when compared with lending rates. Credon allows you to invest in others' personal loans and enjoy rates as high as 13.5 percent from those investments. The minimum investment is only 20 euro, so you don't have to be rich to make your money work for you.

Most of the loans listed are around 2000 euro, and you're not in this alone. There could be 20 investors funding a single loan, and you can invest in several loans, thereby reducing risk. In addition, Credon's buy-back guarantee means that if the borrower defaults, you will get your principle investment back. In such cases, you will not have earned any interest, which is a risk, but you will not have lost your money either.

Types of Investments

Credon offers two types of personal loans:

- Payday Loans

- Personal-Installment Loans.

Personal installment loans are what most people think of when they think of a loan. The borrower asks for a certain amount of money, and agrees to pay back the money plus interest in regular installments. Of Credon's 3 current loan originators, only Sando Investment offers personal installment loans.

A "payday" loan is based on a borrower's anticipated paycheck. A borrower who finds they are short on cash but can demonstrate consistent income (based on paycheck history) can apply for a payday loan, which they pay back in full when their paycheck comes in. Usually, such loans are very short-term (1 to 3 months). That means you can enjoy several quick boosts with little risk. Your 1000 euro can gain another 25 euro with minimal effort on your part.

"Well, that's not much money," you might be thinking. Sure, except sitting in the bank it would only gain 2 euro. Why not gain the most you can?

Investment Customization Tool

Credon's parent company, CreditOnline, is an industry leader in loan-management software, so it's no surprise the site offers an Auto-Invest tool. The idea is very straightforward: You deposit the amount of money you want to invest, set the investment parameters, and let the software do the rest. The software will only invest the money you've deposited, so your budget is safe. Also, the software will only invest in the types of loans you want and for the amounts you want.

For example, you have 500 EUR sitting in the bank and you're tired of only earning 0.2%, so you decide to invest it on Credon. You want to earn good rates, so you set the minimum interest rate to 11.5 percent. You also want to be conservative and diversify your funds rather than tossing everything into one huge loan. So you tell the software never to invest more than 350 EUR in one loan. Finally, you want to see quick returns, so you tell the tool only to invest in loans with periods of 6 months or less.

That's it. That's all you needed to do. The computer does the rest while you enjoy the gains. Truly "passive" income.

Borrower Data Verification

Credon is a loan-originator aggregator, which means by the time a loan is listed on Credon, all due diligence has been done. To be clear, you cannot borrow money from Credon. You can only invest in loans listed on the site. In other words, you are lending your money, via Credon, to someone who has been approved for a loan by one of Credon's originators.

It's those originators, rather than Credon, who are responsible for examining, verifying, and approving the borrowers. Because the European system doesn't utilize FICO credit scores like those in the US, loan originators need to dig into the borrower's financial history. They look at income records, debt history, and sometimes factors such as education. After determining the credit worthiness of the borrower, the originator decides whether and how much to lend, as well as the interest rate.

On the Credon Marketplace, the loan listings include the score given to the borrower, in the form of a grade (i.e. B+), so you know the level of risk involved.

Credon Rates and Returns

The investor rates listed on Credon are between 9.9% and 13.5%, depending on the issuing originator.

Who is Credon?

Credon is a peer-to-peer lending platform established in October of 2021 by CreditOnline, a Lithuanian fintech company that focuses on future-proof lending technology. CreditOnline's loan-business software is well-known, and has received excellent reviews on Capterra and GetApp. CreditOnline boasts a 20-million-euro portfolio, as well as some big-name clients. Even Mintos, a top P2P platform, uses the software bundle.

Credon focuses a lot of attention on the Polish market, with two of its three loan originators located there and offering loans in Zloty. To be clear, as an investor you will work with Credon in euro, but it's important to know the relevant currencies.

Lender/Borrower Ecosystem

Credon aggregates loans from three loan originators. Two of the originators are Polish: Pozyczka Pieniedzy and Super Pozyczka, and they focus on payday loans. The third is, Sando Investment, a Lithuanian originator that offers personal installment loans in addition to payday loans. All loans are listed in euro, though the Polish loans are actually issued in Zloty.

As a loan-originator aggregator, Credon is not directly responsible for vetting borrowers. It is the responsibility of the originators to perform their due diligence, determine which potential borrowers are unlikely to default, approve those loans, and then supply Credon with reliable listings. Credon's function is to give you, the investor, a platform on which to invest your money by lending it for approved loans that earn interest.

Credon's originators also retain 5 - 10% of the loan, which means they share at least some of the risk. Ideally, you'd like to see companies with more "skin in the game," but the site's terms are not prohibitive by any means.

General Data

| General | Data |

| Origin | Latvia |

| Founded | 2021 |

| Offices | Ģertrūdes iela 20 - 6A, Rīga, Latvia, LV-1011 |

| Loan Type | Personal |

| Sign Up Bonus | No |

| Fees | No |

| Interest Rates | 9.9 - 13.5 |

| Min Deposit | 20 EUR |

| Investment Duration | 1 to 36 months |

| Secured Lending | No |

| Currency | € |

Registration & Withdrawal

In order to register as an investor on Credon, you will need to provide the following information:

- Name

- Home Address

- Picture ID (passport, state ID)

Deposit Options:

- A bank account with your name on it

- Paysera

- Transferwise

- Revolut

Credon does not charge any fee for deposits, but the site requires 2 business days to process deposits.

Marketplace

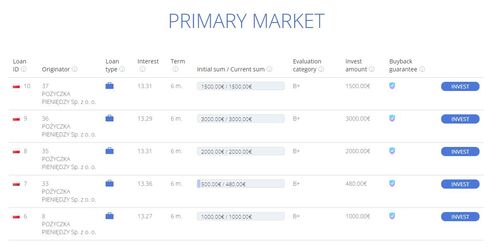

Credon's Primary Market offers personal loans in which you can invest at attractive rates. The format is quite simple and easy to follow, and it provides all the necessary information. Each loan listing includes the name of the originator, followed by the loan type. Next come the interest rate the investor will receive, the term or length of the loan, and a bar that indicates how much of the loan has already been picked up. Next to that are the total investment amount and whether the loan has a buy-back guarantee. Finally, there is an invest button, which initiates the investment process.

Risks Involved

As with any loan, there is always a risk that the borrower will default and fail to pay back the loan. That's why a buy-back guarantee is so important. By ensuring you always get back your initial investment, Credon guarantees everything but your opportunity cost. Sure, it's unfortunate not to earn the interest you had hoped to earn, but that's a far cry from losing large sums of money.

Transparency & Security

Being a licensed platform means Credon must comply with various European Union laws and regulations. For example, all investors must be able to show compliance with the EU's Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) rules.

Due to differences in reporting policies and banking laws, there are many countries whose residents may not invest on Credon. The user agreement lists those countries, including the Democratic People's Republic of Korea (N. Korea), Iran, Ghana, Iceland, Libya, Mongolia, Pakistan, and even some US territories (Puerto Rico and the Virgin Islands).

Furthermore, Credon must comply with the European Union's Law on the Processing of Personal Data and Registration, to which end, Credon "uses an organized data warehouse with the highest security standards."

Our Readers Have Asked:

Is it safe to invest with Credon?

All investments carry inherent risk, and the potential profitability of any investment is proportionate to that risk. That being said, Credon is a reputable organization regulated and licensed by Estonian and EU government entities. Credon is a safe choice both for borrowers and investors.

What is the minimum credit score needed to get a loan from Credon?

The American credit market is based on credit scores issued by its 3 credit bureaus, based on the Fair, Isaac, and Company (FICO) system developed in the late 1980's. The European Union does not use such a system. Credit worthiness is based mostly on income and (the absence of) criminal records.

How do I become an investor on Credon?

To invest on Credon, you simply need to register, deposit funds, and start investing. The registration process will require you to upload a picture ID and complete other Know Your Customer (KYC) steps, but thereafter all you'll need to do is deposit, choose loans in which to invest, and sit back as your money makes money.

How much money will I make?

The projected return on Credon is between 12% to 14%. That being said, it is a young site, and after a few years of quarterly and annual reports it will be much easier to provide an accurate estimate.

What are the risks?

Given the buy-back guarantee Credon offers, you're not likely to lose any money investing on their site. You might end up losing a chance to earn some interest, which is a concern, but your initial capital is safe.

Why do I need to submit ID verification?

The internet is replete with hackers, scammers, and frauds. To curtail fraudulent activity, Credon requires users prove they are who they claim. In doing so, Credon protects itself and you from identity theft. These security measures have become a standard business practice, similar to how a brick-and-mortar bank asks for ID when you open an account.

Is P2P Lending a Ponzi Scheme?

The premise behind P2P lending is certainly not a Ponzi scheme. Payouts to investors are based on actual growth (ROI), rather than redistribution of insufficient sums. That being said, the industry does suffer from a few bad apples and one should take care to patronize only the most reputable companies.

Where is Credon Located?

Credon is located in Latvia, and its parent company, CreditOnline, is located in nearby Lithuania. CreditOnline also has offices in the UK and Argentina.

Verdict

Despite being a young company, Credon has a lot going for it. It's parent company, CreditOnline, has extensive experience in the loan market, which means their management team is well-connected and well-informed. CreditOnline is also in a position to provide Credon with enough funding to withstand initial market pushback as well as the occasional dip. Furthermore, Credon enjoys access to its parent-company's top-tier software, which means management and users will both benefit from a market-tested, user-friendly interface.