An Investigation of Mintos and Their Defaulted Loans

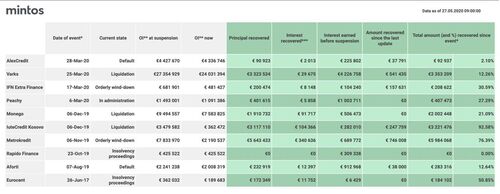

Mintos' Credit Management

One of the reasons our modern society has been able to achieve all that it has is because of one economic principle: credit. P2P lending companies, like Mintos, open another faucet of credit for individuals to utilize and capitalize.

In P2P Lending, credit works in two ways with two sets of people, borrowers and lenders. The former borrow capital in order to fund their projects, real estate, businesses, etc. The latter lends the capital to said borrowers and receives an interest on their principal in returns and repayments.

Generally, the borrowers give up some form of collateral and this is what we know as a secured loan. In other cases, borrowers have something akin to a credit score and history, and lenders decide whether or not to trust them. These are known as unsecured loans. Unsecured loans generally rake in more interest due to their being a higher risk. The higher the risk, the higher the reward and the same is true for its inverse. In every new market and in every new asset class investors find themselves confronted by some form of risk.

Defaulted Loans

Every P2P lending company has at some point dealt with risks. The biggest risk of all is a defaulted loan.

For those who are in need of a reminder, a short definition of default from Investopedia,"Default is the failure to repay a debt including interest or principal on a loan or security. A default can occur when a borrower is unable to make timely payments, misses payments, or avoids or stops making payments."

This blog will cover some of Mintos loan defaults.The P2P lending company that works as the biggest loan originator aggregator. We thoroughly detail their competency when it comes to managing a defaulting loan originator and subsequent fund recoveries.

Mintos has received praise and condemnation for their practices regarding fund recovery. As opposed to companies like LendingClub that use litigation as their first approach, Mintos, prefers to negotiate.

Mintos' risk mitigation team prefers to implement fund recovery strategies. The approach has a greater chance maintaining trust between both, borrowers and lenders. This concept relies on the fact that if they can restructure debt payment between loan originators and lenders, then lenders can still receive their capital, LO's can remain on their platform and Mintos' would have protected their lenders.

The problem with litigation on the side of Mintos on the loan originators is twofold: legal fees are expensive, and legal processes are lengthy.

Finko AM/Varks

Amount Borrowed : EUR 27,354,929

Amount Paid : EUR 5,446,256

Amount Missing : EUR 21,908,673

Interest Recovered : EUR 480,601

Varks, an Armenian loan originator which defaulted on their loans after having their license revoked by the Central Bank of Armenia on March 24th, 2020, has promised and is executing a strategy of fund recovery for investors in Mintos' platform. There are few aspects of this event that reflect Mintos' security efforts and customer satisfaction.

Rather than dealing with either litigation of a form of company agreement take over, Mintos went with their preferred method of adjusting a debt repayment timeline. Even so, in order to embark on this new scheme, Varks was required to operate under the laws of Armenia. The laws indicated that Varks could not collect interest nor commission. This would further mean that Varks could not collect interest from their borrowers meaning their investors could not be paid interest because it wasn't received.

On June 2020, Varks outlined a plan to repay back their investors on Mintos, their principal investment. "The proposal consists of immediate payment of € 2.4 million by 17 June 2020 and a payment by 30 June 2020 for pending payments interest that had accumulated towards investors on Mintos up to 19 April 2020", as per Mintos.

Varks had a high rating of a solid B on Mintos as well as a buy back guarantee. Mintos was put in a difficult position and given the current state of affairs in the lending market, one could assess Mintos' decision as the most reasonable one.

EuroCent

Amount Borrowed : EUR 362,032

Amount Paid : EUR 172,349

Amount Missing : EUR 189,683

Interest Recovered : EUR 11,752

Polish loan originator Eurocent on Thursday July 6th 2017, requested for debt restructuring on Mintos in order for a longer period of time to pay back lenders on Mintos.

Eurocent originally came on to Mintos' platform as a credible and profitable loan originator, however, after just three months the company shares fell about 90%. Users became skeptical and have inquired what was the error on Mintos' end for allowing a clearly unstable loan originator join their marketplace.

Eurocent loan investments operated under a direct structure, implying that in the case of insolvency that Mintos' would take the place of Eurocent and administer rewards to the lenders and charge borrowers for their borrowed capital. Shortly after Eurocent halted public trading, they filed for bankruptcy and Mintos is still dealing with legalities and fund recoveries for the lenders on their website. Since June 2017, Eurocent has made no repayments to Mintos and it would seem that little will change in the near future.

Peachy

Amount Borrowed : EUR 1,493,001

Amount Paid : EUR 672,368

Amount Missing : EUR 820,633

Interest Recovered : EUR 12,631

On March 2020, new regulations were outlined by the Financial Conduct Authority (FCA), and Loan Originator Peachy discontinued operations where they resided in the UK because the new regulation rendered them unprofitable in the coming years. The UK company had been in operations since 2010 and had loaned out 118.3 million EUR just within the years 2018 - 2020. While Mintos perceived Peachy to be a reliable loan originator it had not panned out that way. Peachy communicated to Mintos of the situation and began the process of debt structuring. Peachy promises Mintos that their users would come first.

Peachy has in many ways proven themselves and Mintos' strategy. Since May 2020, Peachy has sent payments of 200K to 250K EUR to Mintos, every quarter. The projected date of completion of the debt repayment is the end of 2020.

Naturally, it is a far different scenario when a company simply dissolves itself versus a company going bankrupt. Either way. Mintos was able to smoothly, calmly and efficiently guide a loan originator through an easy exit out of their platform. Allowing lenders to trust in Mintos' ability to mitigate risk and financial loss.

Capital Service

Amount Borrowed : EUR 19,050,224

Amount Paid : EUR 600,167

Amount Missing : EUR 18,450,057

Interest Recovered : EUR 46,565

Capital Service Poland was unable to make payments in their given time window on Mintos. In April 2020, Mintos suspended them from both their primary and second markets. The suspension period is to be determined. It is alarming considering that Capital Service has almost 20 million EUR on Mintos' platform and 59,905 lenders have their funds tied with Capital Service. Initially, CS had negotiated with Mintos to provide monthly payments of 200K EUR with interest. Shortly after that was agreed upon, CS had halted payments.

Capital Service Poland received special conditions during COVID era from the Polish Parliament. Because of the economic fragility, Capital Service was able to defer on repaying Mintos for the missing funds. The contract between Capital Service and Mintos was under Latvian law. Another unfortunate event was Capital Service not being able to receive funds from their borrowers which they offered on Mintos' platform. Mintos is currently with a legal battle against Capital Service.

Lendo

Amount Borrowed : 12,400,000

Amount Paid : 12,400,000

Amount Missing : 0

Interest Recovered : EUR

Lendo, a subsidiary of Finko Group halted operations in January 2019 due changes in legislation in Armenia. Lendo was still able to manage the remaining lenders and borrowers despite their company being shut down. All users on Mintos' platform were able to receive all pending funds due to efficient collaboration on the side of Mintos and Lendo. By July 2020, all users received both principal and accrued interest due to wise and effective management on behalf of both companies.

Alex Credit

Amount Borrowed : EUR 4,427,670

Amount Paid : EUR 120,625

Amount Missing EUR : 4,307,045

Interest Recovered : EUR 2,317

Alex Credit proves to be a stain on Mintos' marketplace. The Ukranian LO entered Mintos' platform in June 2019 offering interest rates of 350 - 640 % on very short term loans. In March 2020, the advent of the Covid pandemic brought Alex Credit to its knees. Borrowers in Ukraine suffered a great deal due to the global shut down. Rendering the company unable to retrieve payments and unable to distribute them back to Mintos' lenders.

As of August 2020, Mintos has recovered 2% of investors funds, approximating 120,000 EUR. This is by no means enough and investors on Mintos are incredibly unsatisfied by this turn of events. Mintos works closely with Alex Credits' team to produce a sufficient and reasonable fund recovery plan. All in all, the situation appears to be rather grim for Mintos and Alex Credit. In defense of Mintos, Lenders should always be incredibly weary if they see return rates in the hundreds. High reward is almost directly correlated with high risk.

Aforti

Amount Borrowed : EUR 2,241,238

Amount Paid : EUR 232,919

Amount Missing : EUR 2,008,319

Interest Recovered : EUR 12,379

Aforti Finance is a Polish loan originator listed on the Polish stock exchange. In December, 2019, Aforti Finance stopped making payments to Mintos' lenders. Their loans were considered defaulted and shortly after Mintos came into contact with Aforti to relay to their users that they were in discussion. Initially, Aforti was co-operative and made regular payments, however, it was not long until that stopped. Mintos initiated a legal battle with Aforti, but due to Covid-19 the legal outcome of this dispute may be delayed until further notice.

The terrifying aspect of this, is that Aforti still runs and continues to be a profitable loan originator. In the greater picture, it could mean that loan originators may have a way to get out of paying Mintos without going bankrupt.

luteCredit Kosovo

Amount Borrowed : EUR 3,479,582

Amount Paid : EUR 3,479,582

Amount Missing : EUR 0

Interest Recovered : EUR 110,587

LuteCredit Kosovo had their licenses invalidated by the Kosovo financial authorities on December 19th, 2020. Mintos and LuteCredit formulated a debt restructuring to retrieve lender funds. Within 6 months, Mintos successfully completed their fund recovery and lenders saw their capital and interest returned.

So What Do We Think?

Every outcome is different when it comes to fund recoveries. It is difficult to determine how successful a company will be at retrieving the funds of their users. However, what these cases do question is when does Mintos utilize legal contracts and disputes in the event of a loan originator going bust or refusing to pay their side of the deal.

In the case of a problem with a defaulting loan, Mintos does not exercise the legal binding contracts that they have with these companies. Rather, they frequently opt to reason and restructure debt repayment with the companies they work with.

A Defense of Mintos

To Mintos' defense, it is difficult to determine what is the most preferred outcome for a defaulted loan. In a scenario where Mintos pursues litigation against a loan originator, this would surely take a fair amount of time and a fair amount of money. The money does not come out of the pockets of anyone other than the lender. The end result would be, lenders miss out on a solid percentage of their investment principal included. Mintos would stop collaborating with said loan originators and the market would slowly over time cease to exist. This is usually the case for litigation.

A successful debt restructuring has always maintained customer satisfaction on Mintos. Reasonable lenders are well aware of the risk that comes with lending money to individuals who could not get a reasonable loan anywhere else. Investors understand the risk of not receiving the profits on their investments. Investing is not a guaranteed money maker and still requires research and attention. Mintos does what it can and when it succeeds, it's good enough.

Debt restructuring takes time and often enough, even after the payment plan is structured, it can be unfruitful. Loan Originators still either leave with their funds in their pockets or go bankrupt. As seen with Capital Service and Alex Credit, but, not all companies have defaulted and disappeared. Many companies have in fact stayed true to their financial obligations and in the long run all players understand that such are the signs of a healthy financial ecosystem.

Conclusion

In the long run, Mintos will either find a way to ensure more appropriate, reasonable and time efficient strategies for fund recoveries, or crumble in its attempts. Time will tell. It is of our belief that Mintos will rise to the challenge and step by step, as they're already doing, redefine the P2P Lender-Borrower ecosystem.