Monthly Report Mar 2021 Entry #3

Please read P2PIncome's most recent investment-portfolio report for 2026.

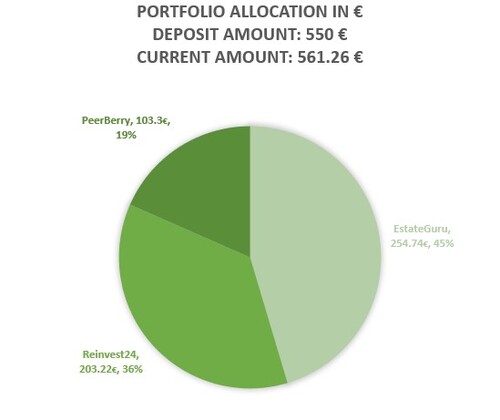

Welcome to our monthly report on P2P platforms we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are PeerBerry, Reinvest24 and EstateGuru.

The current portfolio breakdown:

February showed that once again PeerBerry has proven itself to be a top performing Peer-to-Peer lending service. Reinvest24 is just behind PeerBerry and EstateGuru continues to struggle behind the two.

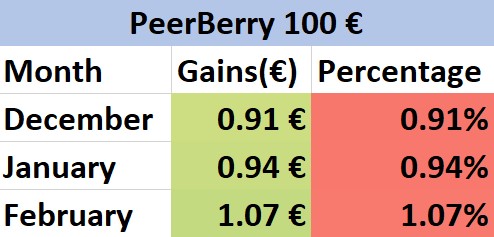

PeerBerry

PeerBerry was founded in Latvia in 2018, the minimum investment entry is 10 EUR and the projected yearly return ranges from 9 to 12 percent.

PeerBerry is a leading Peer-to-Peer lending service in Europe. They were founded by a profitable lending group called Aventus Group.

Before Aventus Group created PeetBerry they were a lending service on one of Europe's biggest lending aggregators, Mintos. After witnessing firsthand the success and functionality of Mintos, the executives at Aventus Group decided to create PeerBerry.

Starting Amount: € 100

After 5 Months: € 103.30

Total Percentage Increase: 3.3%

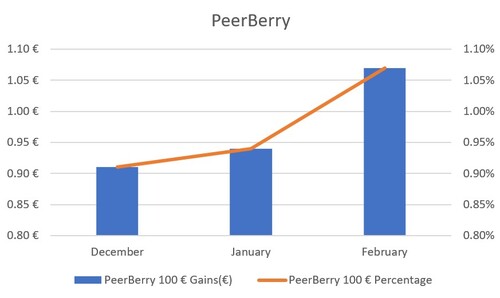

PeerBerry has continued to provide our account with consistent returns. Each month the platform provides about 1% compounding monthly in interest on our principal. We have noticed, quite often, borrowers finish their loans contracts on PeerBerry before the final date, even long term loans of 6 or more months, that are for the purpose of real estate and are being completed before the loan agreement is up. Borrowers benefit from this because the faster they repay their loan the less they have to pay in interest fees.

Investors benefit from this because of the amount of times this enables their investments to compound in between loan contracts.

This aspect of PeerBerry also ends up providing a lot of liquidity for investors. For example, our auto-investing tool is configured to ensure that we are only investing in loans that are low and medium low risk. Even so, we have found little to no problem at all with the results and efficiency of our auto-investing tool. With PeerBerry we are reaping all the benefits we can, not because of our expertise but because of the product itself and the ecosystem PeerBerry supports, operates smoothly.

PeerBerry as it is now is out performing all the other platforms we have tested and documented.

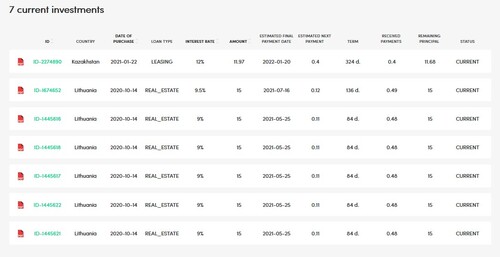

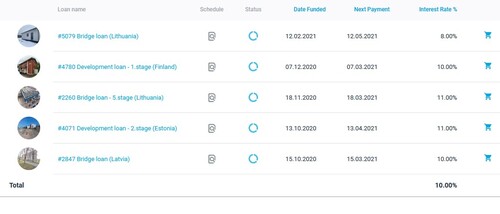

Marketplace Review

Currently all of our loans are issued in real estate projects. it can be seen that our yearly return ranges from 9 - 12 percent. This was the range that we opted for in our auto-investing tool, though, we prioritized safety over return. This can be seen in the majority of our loans only having an internal rate of revenue (IRR) of 9 percent.

The reason why one of the loans is 12 percent is not necessarily because it's a leasing loan or real estate, rather, it's because the loan originated from Kazakhstan. Due to the economic position of Kazakhstan it is difficult for the borrowers there to be approved for loans because of their location.

To make up for the preconceived risk, the interest rates are higher.

Most of our loan agreements have three more months to go. It's difficult to tell which one which will pay back early, which will pay on time and which will default. Considering the amount of loans that we have recycled through PeerBerry it is hard to say what the future holds.

Considering the experience and track record with our investments so far, we are not worried.

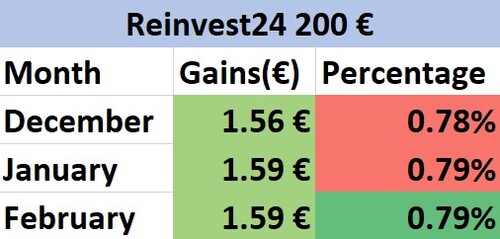

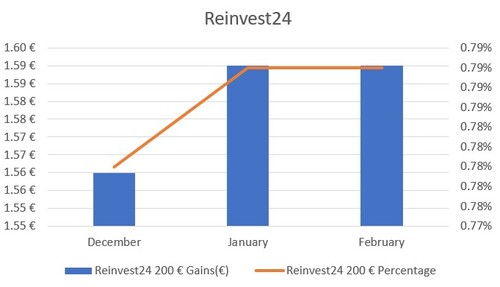

ReInvest24

Reinvest24 was founded in Estonia in 2019, the minimum investment entry is 100 EUR and the projected early return is roughly 14.6%.

Reinvest24 has been consistently paying out interest and rental equity payments. All payments go according to schedule in amounts that seem to be bearable. It's more appreciated that once Reinvest24 started paying out it continued, there has been no abnormal behavior or bad news. Much like PeerBerry in that regard.

Unlike PeerBerry, the sum of the payments we are seeing from Reinvest24 is simply not enough. The platform advertised that we would receive a 14.6 percentage return and what we are seeing is something more akin to a 7 or 8 percent IRR.

Starting Amount: € 200

After 5 Months: € 203.22

Total Percentage Increase: 1.6%

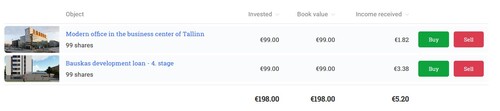

Even though the amount is not that attractive there are other factors at play that make Reinvest24 a great place to invest. Not to mention, our loan contracts span over the 18 months which means there is still time for these real estate companies to fully pay out the amount of interested initially promised as well as principal.

Because Reinvest24 provides investors with real estate equity, investors also receive a profit on their capital gains. The property which you might be holding for two or three years will most likely increase in value, as property tends to increase in value over the years. In short, investors who are holding the equity of property are likely to receive capital gains profits from a natural increase in property value.

Marketplace Review

Reinvest24 has installed a secondary market on to their platform. Which is great for a few reasons. First one, Reinvest24 does not offer many loan offerings but they do offer loans that span a very long time. A secondary market provides a new area to invest in for those who suffer from Reinvest24's lack of diversity and loan options.

Furthermore, it also gives the investors who are suffering from lack of liquidity a way to cash out early.

In terms of our investments we can definitely say we are happy to see a consistency in payouts. Though they may be less than what we had hoped to receive it is assuring to know the payments are coming and on time.

Though both properties were purchased at the same time, funding did not begin at the same time for the two projects. During a loan cycle that spans 18 months it's difficult to determine whether or not the investment is going to be great in the first 5 months. We hope to see Reinvest24 continue to improve on the aspects of their marketplace as well as make good on their promise of a higher yield.

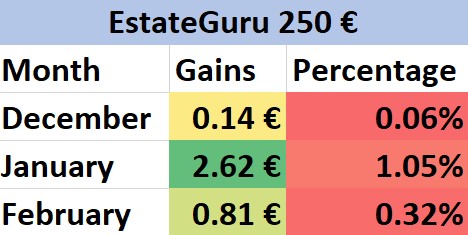

EstateGuru

EstateGuru was founded in Estonia in 2013, the minimum investment entry is 50 EUR and the projected yearly return ranges from 8 - 12 percent.

EstateGuru is the largest real estate crowdfunding platform in all of Europe. They take the top position in terms of market cap, investor size, portfolio size and location reach. EstateGuru funds more real estate projects all over Europe than any other platform.

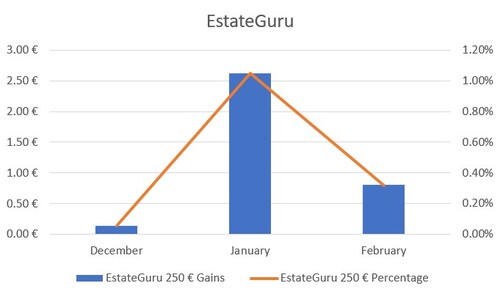

Starting Amount: € 250

After 5 Months: € 254.74

Total Percentage Increase: 1.9%

EstateGuru has been very disappointing for a few reasons. The first one, EstateGuru is the only platform that has come back to us with late loans. Secondly, the consistency of the loan repayment is not only infrequent, it is also unsubstantial.

Out of the five months investing with EstateGuru only one project paid out a decent amount of interest but it came with some early repayment in an amount of 12 EUR which cannot be reinvested on their platform. All loan investments start at a minimum of 50 EUR. On PeerBerry this 12 EUR would have reinvested the next day. We spoke on our previous monthly report that we were concerned of EstateGuru's inconsistent payments, we are displeased to see it continue.

Marketplace Review

EstateGuru has neither claimed any of their loans are late or in default. The rumors is that this is a failure on EstateGuru's transparency and credibility and that behind the scenes is rather chaotic.

From our experience and observations, we suspect EstateGuru has certainly seen a drop in volume. We found through our investigations that many investors at this time are feeling as if EstateGuru has not been clear about their late and defaulted loans.

The loans that we have in our profile have had their interest rates reduced and without any form of notice or formal update of such changes. Perhaps, the current pandemic has affected EstateGuru's marketplace. Imitially, the p2p lending platform had made the statement that everything was business as usual. Now that the situation is changed, EstateGuru may be trying to find a solution or another way to tell their investors that some serious fund recovery initiatives are underway.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Comparing Platforms

EstateGuru, though offering high rates on their platform for investors, have failed to pay out the promised amount on each loan contract. The Payments are neither often and nor reflective of how much interest we should be yielding. In PeerBerry we put in 2/5 of what we deposited in EstateGuru and are seeing comparable returns. The only difference is PeerBerry's payouts are far more consistent.

| Platform | Deposit | Payout | Yield |

| PeerBerry | € 100 | € 3.30 | 3.30% |

| Reinvest24 | € 200 | € 3.20 | 1.60% |

| EstateGuru | € 250 | €4.74 | 1.90% |

In regards to comparable returns, even though we invested 2.5 times the amount of money in EstateGuru than we did in PeerBerry we are only receiving an increase in returns of about 35% from EstateGuru. The five months alone has been convincing enough that if we were to restart this investing campaign we would allocate more capital into PeerBerry and less into EstateGuru.

Reinvest24 is operating properly with very little issues, but in comparison to PeerBerry's great performance and EstateGuru's questionable performance, it's difficult to find anything outstanding. Payments are consistent and there seems to be no real problems with the loan contracts we are engaged in.

Long and Short Term Loans

After five months we have enough of a timeline to start comparing the differences between long term loans and short term loans. EstateGuru and Reinvest24 are providing us with less returns, partially, because the loans are long term and related to property. But also, because PeerBerry is constantly turning over loans, letting money come in and out of their system.

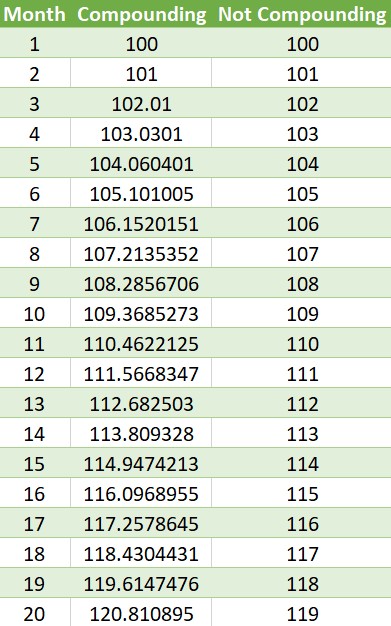

A certain magic exists on PeerBerry and this is because of the compounding interest that is naturally built into PeerBerry's investing software. Every month the money that is received increases and is reinvested into the portfolio. And so, what actually happens is every month investors receive 1 percent of whatever amount of capital they had before. So the first month is 1% of 100, the second month is 1% of 101, the third month is 1% of 102.01, the fourth month 1% of 103.1 and so on.

The incremental gain that occurs each month accumulates and becomes exponentially higher as the investment continues.

For further illustration between compounding and non compounding investments:

The table shows us although in small numbers the profound change that compounding interest can have. We can use this table to understand the difference between PeerBerry and EstateGuru. PeerBerry as an investment service will provide additional percentage based on revenue based on the earnings in the previous month. Whereas, EstateGuru won't change the amount of interest it pays out. This is a fundamental difference between short term and long term peer-to-peer investing.

Or in other words, if the same investor on a long term loans earns 1% of a 100 EUR a month, then the invetor will receive one euro for each month until the end of loan contract.

Verdict

About 5 months ago we invested 550 EUR into three accounts. All of which promised us a return of above 9 percent. At this moment we should have yielded in interest, at the very least, 3.7 percent. As of writing this entry, we are up only 2 percent.

Almost being half way through, we have found that our biggest mistake was putting more trust in the biggest peer-to-peer lending service rather than the new kids on the block.

Granted that new companies may be more suitable for short term gains, whereas, long term companies tend to outperform in the long run. It will most likely take a year before we can truly say which platform provides the best investing experience. Especially considering the variation in nature of each platform.

We are still incredibly pleased with PeerBerry's ability to service our account. PeerBerry moves quickly to reinvest all capital and earnings. EstateGuru still proves to be a thorn in our portfolio. Bringing in lower than expected payouts each month is something that should be addressed by them. Unfortunately, the lack of transparency and outreach makes EstateGuru somewhat worrying.

Reinvest24 is operating at what we would consider average. That being said, the interest rates and payouts are less than what were initially promised.

Otherwise, we are hoping Reinvest24 will rise to the challenge of keeping their promise. Until Reinvest24 and EstateGuru up their game, PeerBerry assumes the top position.