Monthly Report Jan 2021 Entry #1

Please read P2PIncome's most recent investment-portfolio report for 2025.

In order to illustrate our dedication to our readers and to these platforms we will begin bringing to light the progress of our own Peer-to-Peer lending portfolios.

We have decided to begin with three platforms that we believe are in alignment with what every investor should look for in a lending platform. All platforms chosen provide collateral on their loans, each company has a proven track record when it comes to fund recoveries and only required an affordable minimum entry.

While we will only be showing a part of our overall portfolio it will bring to light the experiences that we have had with humble amounts of capital. All platforms are based in Europe as we have experienced the most affordable, profitable and secure sites are found in Europe.

While we would not consider the first few months a good start, it was not necessarily a bad one. The first thing which is noticeable is that the auto-investing tool, if left unattended, could cause extended periods of cash drag. Auto-investing tools generally don't activate the moment you set them up, they are factored into the next loan cycle. Counterintuitively, It is impossible to predict what kind of loans will be entering the market. Therefore, the more specific your auto-invest, the longer it will be to make a profit. Manual investing is instant and might prove to be a more efficient way to into the loan market.

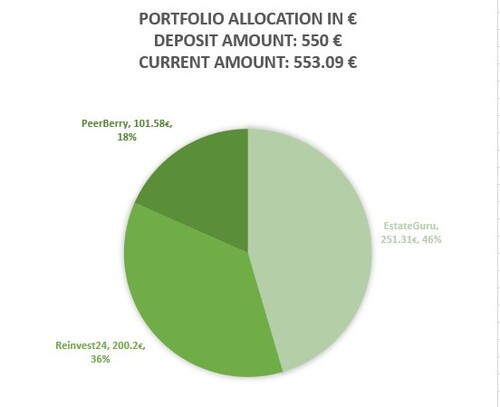

There was a total of 550 EUR invested into the three platforms.

The three sites were chosen because of their proven approach to fund recovery, transparency and loan type.

PeerBerry

PeerBerry is an Lithuanian Peer-to-Peer lending service. They are loan originator(LO) aggregators which implies that they as a platform host multiple loan originators who then service loans to borrowers. PeerBerry works as the intermediary between the LO's and the private lenders. PeerBerry requires a 10 EUR minimum deposit and offers a 9 -13% IRR.

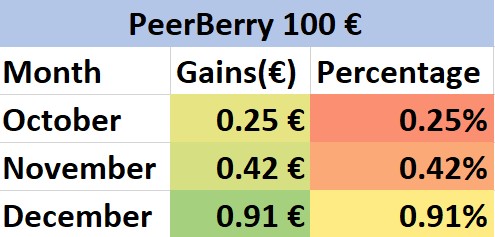

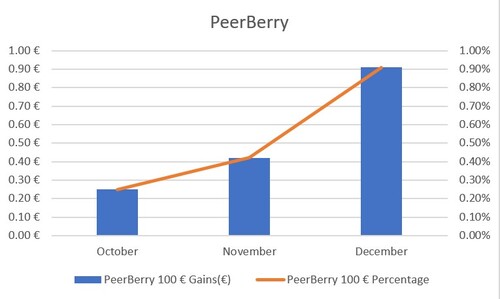

Starting Amount: € 100

After 3 Months: € 101.59

Total Percentage Increase: 1.6%

PeerBerry was founded in 2017 by loan originator Aventus Group. Aventus is a profitable lending organization that has a proven track record and produces audited financial statements annually. Similarly, PeerBerry provides the lenders on the platform with the financial statements of all of their Loan originators so that investors can make a decision based of historical facts rather than abstract ratings and rankings.

Investing on PeerBerry allows you to select from a myriad of loan types, cycles and amounts. There are many loans on PeerBerry and so one does not experience much cash drag on PeerBerry's platform. PeerBerry performed at a roughly 8% yearly return. As investors, within three months, we received 1.6% of our total portfolio.

Because the loan cycles on PeerBerry are short, the auto-investing tool works regularly. We have experienced many loans pay back early and money being reinvested the following day by our auto investing parameters.

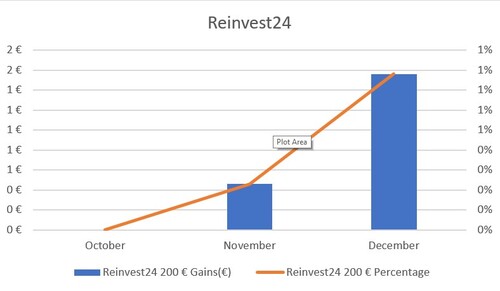

Reinvest24

Reinvest24 is a Peer-to-Peer lending real estate equity investment platform. Their business model is rather complex but interesting, and secure and profitable. In essence, lenders on Reinvest24's platform are lending money to real estate companies in exchange for holding equity of the property until the loan is paid back. Reinvest24 requires a 100 EUR minimum deposit and offers a 14% IRR.

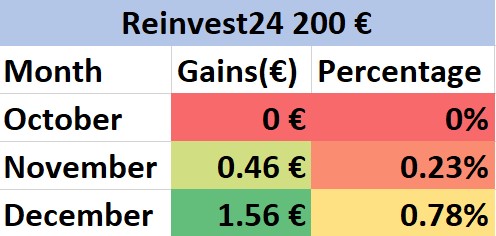

Starting Amount: € 200

After 3 Months: € 202.4

Total Percentage Increase: 1.2%

Reinvest24 is a new platform that started in 2018 in Tallinn, Estonia. Reinvest24 has partnerships with many local rental companies in Estonia. They purchase real estate at a great value in populous areas, renovate the real estate and than the local rental companies turn those renovated pieces of property into AirBnBs and other commerce type stores.

Because of Reinvest24s size and nature of business, finding projects can be a cumbersome task. Reinvest24's marketplace, although full of quality, is lacking in number and diversity. There are really only several projects at most that investors can fund. Perhaps when Reinvest24 scales and grows, then so will their marketplace.

Minimum entry deposit into Reinvest24 is a 100 EUR, prior to funding our account we knew the market place only had several options. So we chose to fund two projects chosen primarily for their central location and guaranteed return. Many of the development loans we invested in took several weeks until they were fully funded and therefore being paid back will take even longer as well.

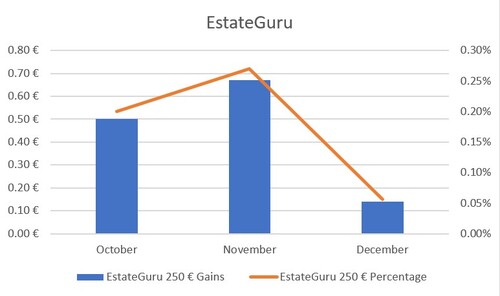

EstateGuru

EstateGuru is another Estonian Peer-to-Peer lending platform that deals solely with Real Estate. Though there business model is simpler than those of Reinvest24s. EstateGuru offers loan in just about everything real estate related. From renovations, to building homes, apartment complexes, stores, you name it. If it has property, than EstateGuru can finance it. EstateGuru requires a 50 EUR minimum deposit and offers a 8 -12% IRR.

Starting Amount: € 250

After 3 Months: € 252.02

Total Percentage Increase: 0.8%

EstateGuru drew our attention not only because its success in every aspect a Peer-to-Peer lending company should have, but also because of it's simplicity. Loans are guaranteed with first or second rank mortgages and the LTV ratio never goes above 50%. There is always enough capital for protect investors while being able to provide lenders with an attractive return on investment.

EstateGuru was disappointingly troublesome at first. It took a rather long time before our auto-investing tool fully funded our account. For the purpose of review we wanted to see how long it would take and it took EstateGuru a month to completely invest our 250 EUR into a total of 5 projects. Even so, when it did completely fill out investment loans it still took a while before those loans reached their needed amount. Ultimately, EstateGuru had a lot of cash drag.

We believe EstateGuru will be our most profitable venture and even though the returns on the three platforms are close in number, EstateGuru proved to be the least profitable. All things considered, lending money on peer-to-peer lending is a not a three month ordeal, although it can be. In order to truly be profitable one would have to track the performance of the portfolio, at the very least, for over a year.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Verdict

At this point in time it is too early to consider whether or not we want to deposit more in to PeerBerry, considering that out of three it is performing the best despite being a smaller loan portfolio. It is interesting to see Reinvest24 early on, despite being a much smaller platform, outperform a giant like EstateGuru.

Either way it is worth reiterating that it is too early to decide whether or not the loans will be late or paid in full. It is still valuable to document the journey. Not only for ourselves but for our readers who might have encountered similar problems or were wondering what kind of problems could exist.

There are other platforms we wish to start investing with. Platforms such as Mintos, Swaper and October are more European P2P lenders that garner our attention and interest. We are always looking for sites that, above all, can provide a reasonable interest rate while securing investors' capital as much as possible.

Above everything we chose these sites because they report incredibly low default rates. Managing a lender/ borrower ecosystem is a difficult thing to do. Ensuring that borrowers pay back and on time is what determines the quality of a Peer-to-Peer lending service.