Monthly Report Feb 2021 Entry #2

Please read P2PIncome's most recent investment-portfolio report for 2025.

Welcome to our monthly report on P2P platforms we find the most exciting and worthy of a trial. Our current set of P2P lending platforms are PeerBerry, Reinvest24 and EstateGuru.

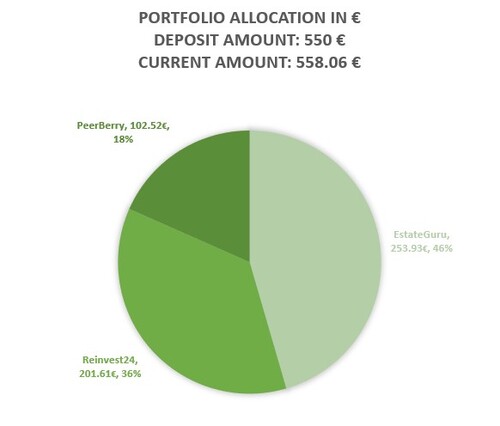

The current portfolio breakdown:

January proved to be a better month than November and December for earnings. All things considered and the state of the economic markets, it's promising that borrowers are still paying back on time. None of the loans selected on any platforms have become late or defaulted.

PeerBerry remains as the most promising platform, followed by Reinvest24 and lastly EstateGuru. Though all platforms have been paying back at interest at a reasonable rate, EstateGuru is the only one that struggles to be consistent.

PeerBerry

PeerBerry is a Latvian Peer-to-Peer lending service which has seen a tremendous increase in user growth from the beginning of their operation in 2018, to today. PeerBerry is a product of the loan originator Aventus Group, a profitable and successful lending company in Europe.

Prior to PeerBerry, Aventus Group issued loans out on Mintos' platform. After having seen Mintos' success they decided they too would open a Peer-to-Peer lending loan originator aggregator service.

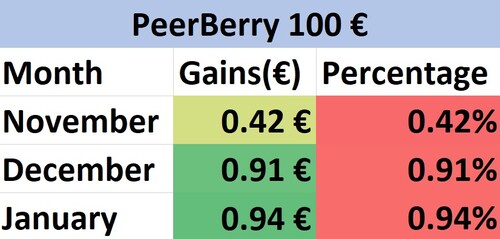

Starting Amount: € 100

After 4 Months: € 102.52

Total Percentage Increase: 2.52%

Their platform connects lenders to loan originators to create and maintain a lending borrowing ecosystem.

In order to utilize Peerberry's lending service, their marketplace requires a 10 EUR minimum deposit for either short term or long term loans. Projected yearly return rate on PeerBerry ranges from 9 -13 percent.

Marketplace Review

Currently, PeerBerry has provided us a consistent return of almost 1% per month. Many loans are paid back early but PeerBerry's auto investing tool is quick to reinvest any moneys returned. The auto-investing tool works well and requires little optimization.

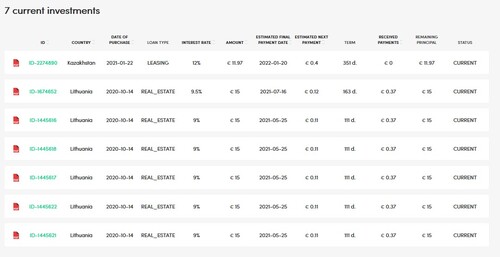

Quick reinvesting also enables a compounding effect to happen with our portfolio which means the yield may be greater than the projected average of the loans we are currently funding. Here is a snapshot of our current PeerBerry portfolio.

Our parameters were the countries Lithuania, Estonia, Russia, Kazakhstan, and all loans were backed by property in one way or another. We believe collateralized property is a great way to enter the P2P lending space because in case anything goes wrong there is a hard physical asset with undeniable value to be sold off to guarantee principal.

Though on PeerBerry there are seldom any late or defaulted loans in the past four months. PeerBerry was the fastest to invest our funds, start the process, and reinvest funds incase of early repayments. In terms of cash drag, PeerBerry seems to provide the least out of the three platforms.

ReInvest24

Reinvest24 is an Estonian Peer-to-Peer lending service founded in 2018. They offer real estate P2P equity and lending services. They personally find and vet borrowers who are professionals working in real estate companies. Through their strategically developed relationships they connect real estate companies with individuals around the world to form and maintain a lending borrowing ecosystem.

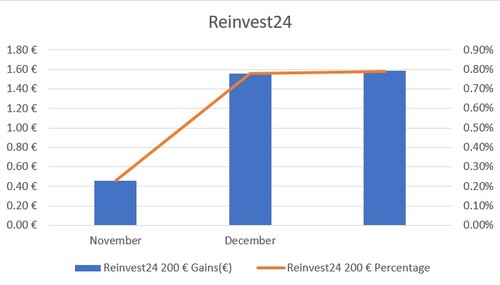

Starting Amount: € 200

After 4 Months: € 202.62

Total Percentage Increase: 1.3%

The borrowers are people who own property, develop property, and turn property into a service like hotels or AirBnBs. The investors are people like you. Reinvest24's goal is to connect both the borrower and the lender. The attractive feature here being that Reinvest24 offers you a stake in the property that you're lending capital too.

This temporary stake allows you to not only profit from interest from the loan but allows you to also receive part of the monthly rent associated with the property your helping fund. It would be more correct to think of Reinvest24 as as Peer-to-Business model.

Marketplace Review

Reinvest24 does not provide an auto-investing tool and so our loans were chosen by hand in their marketplace. The real reason these two options were chosen is because they were the only two available! Something worth considering with Reinvest24, the options are incredibly limited. There is a minimum deposit requirement of 100 EUR and the yearly return comes to an estimate of 14 percent on Reinvest24.

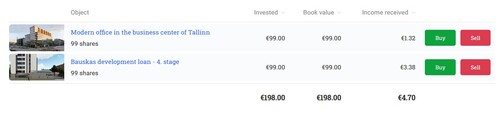

To Reinvest24's favor, the projects details on every listing are fully disclosed and the business plan is available for both of them. There is a one EUR fee per loan funded. Here is a snapshot of our current Reinvest24 portfolio.

The details associated with every project explain how the borrower will make their money, the interest rates agreed upon, the projected payouts from rental equity, duration of ownership, and so on. The transparency on Reinvest24 is top tier in this respect.

In the first two months it took a while for the projects to get funded and start paying interest. Cash drag on Reinvest24 can be expected. That being said, in the last third and fourth months both rental equity pay outs as well as interest has been more consistent, which is a good sign.

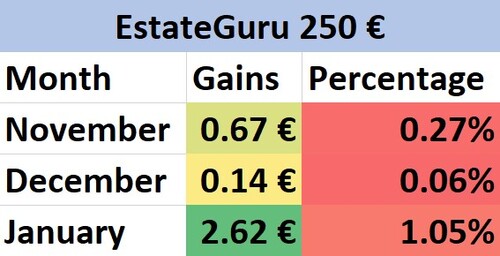

EstateGuru

EstateGuru is currently the largest real estate peer-to-peer lending service in Europe. They have funded over 186 million euros through property. The minimum investment is 50 EUR and they require 250 EUR for those interested in using their auto-investing tool. Users can expect loan contracts that span 6 - 60 months with a yearly return ranging from 9 - 12%.

EstateGuru was founded in 2013 and has since established itself as an authority in the P2P lending space.

Starting Amount: € 250

After 4 Months: € 253.93

Total Percentage Increase: 1.6%

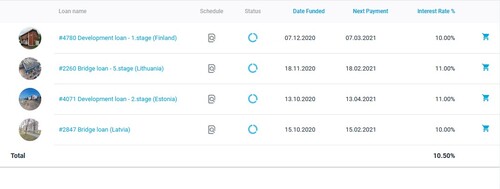

EstateGuru services a wide range of peer-to-peer real estate lending loans. In their market place you can find development loans, bridge loans and business loans, all come with a varying degree of risks and interest. EstateGuru borrowers are also based in Europe, the P2P platform services loans from Germany, Spain, Lithuania, Latvia, Finland and Portugal.

Marketplace Review

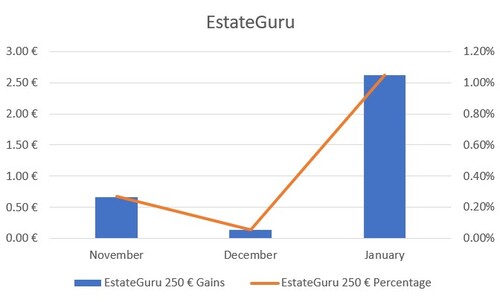

After three months of waiting for EstateGuru to show promise, it did so right at the end. The reasoning was most of our capital was tied in projects that were waiting to be fully funded.

We utilized EstateGuru's auto-investing tool in order to find these loan contracts. EstateGuru's auto-investing tool required a few weeks of optimization to finally fill up the loans which all added to the amount of cash drag experience. Here is a snapshot of our current Estateguru portfolio.

All the returns are rather high for EstateGuru and seeing as they all had first rank mortgages we felt that their safety was promising enough. This was a great result considering the time it took to optimize the auto-investing tool.

In regards to the portfolio movement, had the first few months on EstateGuru not been so slow we would welcome January as a great month. As of now, it's hard to tell if the journey will be filled with ups and downs or a consistent return like PeerBerry has shown so far. The signs will be clearer in next months report.

Market Type

Consumer Loans

Average Returns

9 - 12%

Minimum Investment

EUR 10

Signup Bonus

0.5%

Registered users

70,000

Total funds invested

EUR 1.8 Billion

Default rate

7%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

PeerBerry is an excellent P2P platform to its 100 percent successful fund recovery track record. They offer slightly below market interest rates in exchange for a guarantee users will never lose their funds.

Market Type

Mortgage Loans

Average Returns

12 - 17%

Minimum Investment

EUR 100

Signup Bonus

EUR 10

Registered users

25,000

Total funds invested

EUR 40 Million

Default rate

0%

Regulating entity

Self-Regulated/EU Compliant

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, Bank Card, TransferWise

Withdrawal methods

Bank Transfer, Bank Card, TransferWise

Reinvest24 is an equity backed real estate rental P2P lender. Though they are a much smaller P2P lending platform in comparison to the top P2P lenders. They deserve a high place on the list because of their attention to detail and successful execution of business goals.

Market Type

Mortgage Loans

Average Returns

8 - 13%

Minimum Investment

EUR 50

Signup Bonus

0.5%

Registered users

150,000

Total funds invested

EUR 700 Million

Default rate

6%

Regulating entity

Bank of Lithuania

Buyback guarantee

Secondary market

Payment methods

Bank Transfer, SEPA, Credit Card, TransferWise

Withdrawal methods

Bank Transfer, SEPA, Credit Card, TransferWise

EstateGuru is a highly recognized and successful P2P Lending company. What makes EstateGuru as P2P Lender so profitable and secure? Explore the breakdown with P2PIncome's thorough analysis of EstateGuru's strengths and weaknesses.

Comparing Platforms

It is still too early to give a detailed analysis on the comparison of the platforms. Investment cycles for both Reinvest24 and EstateGuru far exceed the cycle for PeerBerry.

| Platform | Deposit | Payout | Yield |

| PeerBerry | € 100 | € 2.52 | 2.52% |

| Reinvest24 | € 200 | € 2.62 | 1.30% |

| EstateGuru | € 250 | € 3.93 | 1.90% |

Once the cycle has reached a year than we would be able to provide a conclusive opinion on which investment was more profitable and worthy of more of our money. So far, Reinvest24 is struggling behind because of it's first few months of cash drag. PeerBerry is performing very well and EstateGuru is performing rather poorly. Investing into development projects and real estate will sometimes come with late payments or delayed crowdfunding completion.

On the other hand, they are more secure loans. Whether or not they will be more profitable only can time tell.

Observations on Cash Drag

Other general observations include the experience of cash drag while investing. For context, many critics express their feelings on the loan market as if everyday there should be new loan listings in the marketplace. As if they are scanning the marketplace to deposit more without experiencing the loan being paid back. Due to a supposed lack of market volatility many investors might be put off by the idea of not being able to invest everyday.

We believe that this is a minor issue. The quantity of the loans pale in comparison to the quality of the loans. If the marketplace is over flooded with listings than the scales of demand and supply may be tipped out of balance. If there are not enough investors and too many listings, nothing will ever be properly funded. Cash drag can be seriously harmful to your portfolio growth, especially on listings that take too long to be fully funded. When you choose a site comfortable for you, prioritize that the loans are worthy investments over the size of the marketplace.

In short, do not be discouraged by a marketplace that issues out new loan requests slowly as it might be happening for good reason, like making sure all the loans actually get funded. And if you dedicate time to your own due diligence and know what you are purchasing you should not need to be actively looking for new projects to invest in.

Verdict

All the platforms we chose for this segment were the ones we believed to be the best. There is no reason to choose anything less as investors. These were the best platforms considering what we were looking for: safety and consistency of return.

When we consider safety and consistency, it can be noted that PeerBerry has done a great job. There was very little cash drag, the capital even if paid back early, is reinvested in the next day. The marketplace is constantly being updated meaning we don't have to check everyday to see what's going on or be forced to change the parameters of our auto-investing tool because PeerBerry's platform can service whatever our request is.

EstateGuru has left a bittersweet taste in our mouth for having taken so long to start producing pay outs. Though there last payout was promising it is too early to determine whether or not the experience is recommendable. EstateGuru's marketplace does experience cash drag on new listings that are added and sometimes there is cash drag because the amount of time it can take to get projects fully funded.

Reinvest24, like EstateGuru, takes rather long to be funded and unfortunately, there aren't many loans to choose from. That being said, the loan duration spans for a year which is longer than most new P2P lending sites. Otherwise, it is rather enjoyable to receive two forms of payouts on Reinvest24. The consistency has also noticeably increased so hopefully by the next monthly issue I can say the same good things about PeerBerry and Reinvest24.

To finalize, we're probably happiest with PeerBerry. It's easy to understand why they have been the fastest growing P2P lending platform in Europe.